Accountants

Empower Your Clients

With An All-in-One Credit

Management Solution!

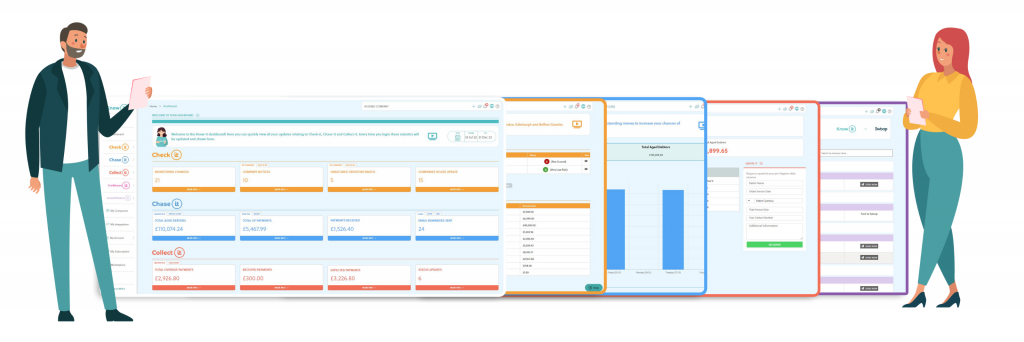

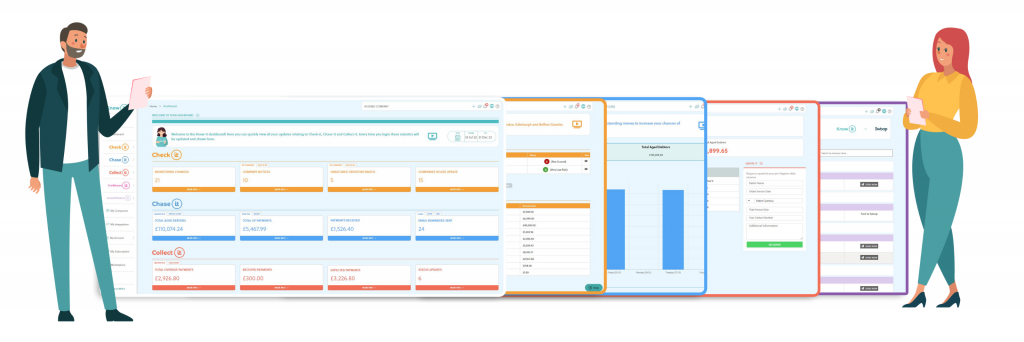

Credit Management Made Simple

Company credit checking & monitoring,

automated payment chasing and collect

overdue invoices all in one place!

All-in-one credit control

platform helping SMEs mitigate

credit risk, reduce debtor days

& boost cashflow

We are available on the Xero App Store, QuickBooks App Store and Sage Marketplace!

Help Your Clients Mitigate Credit Risk, Reduce Debtor Days

& Boost Cashflow With One Platform

Credit Checking with Automatic Monitoring

Check-it allows businesses to make better credit decisions

with real-time credit data from Creditsafe and

company information from Companies House, The

Gazette & unique data insights.

With automatic monitoring they'll always be notified

of changes to customer credit reports!

Automatically Chase Payments

Chase-it fully automates the payment chasing process,

allowing businesses to schedule payment reminder emails, letters

and SMS messages with fully customisable templates.

Seamlessly integrate Xero, Sage, QuickBooks or

FreeAgent accounts to automatically chase payments!

Our Microsoft 365 integration means users can send

chasers from their own inbox.

Collect Unpaid Invoices

Collect-it provides instant quotes to collect

unpaid overdue invoices through our prelitigation recovery partner, Darcey Quigley & Co.

Businesses can stay up to date with real-time case updates, receive

instant quotes for recovery and only pay a fee if

their debt is collected!

Invoice Finance

Invoice Finance-it allows firms to find the funds to

cover invoice payments easier and faster than before.

It gives a business' cashflow a nice boost instead of waiting to

be paid by borrowing against outstanding

invoices. Invoice Finance-it is powered by Swoop.

How does credit control improve ROI?

- Effective credit control results in more efficient processes.

- Helps your clients make more informed credit decisions.

- Businesses are paid quicker.

- Boosts cashflow that can be used to re-invest and grow business.

- Improves client relationships with you and their customers.

- Less debt written off.

- Automating credit control saves time, allowing businesses to focus their efforts on growing sales.

How Accountants benefit!

- Grow your practice.

- Help more clients mitigate credit risk and get paid quicker.

- Increase your revenue.

- Flexibility to offer as an integrated solution or resell to your clients.

- Provide even more value to your clients.

- Increase customer retention.

- Boost profitability for you and your clients.

Our Integrations & Partners

FAQs

Know-it helps you better serve your clients by offering a fully automated credit control solution, helping them mitigate credit risk, reduce debtor days and boost cashflow!

Ensure your clients make more informed credit decisions, write off less debts and grow their revenue, in turn improving your client relationships.

By fulfilling your clients’ needs your practice will grow and your own revenues will increase, it’s a win-win!

Yes, we offer CSV file import functionality which allows users to synchronise their sales ledger if they don’t use Xero, Sage, QuickBooks or FreeAgent.

Our offering for accountants is fully bespoke. Get in touch with us to find out more!

Know-it is the all-in-one credit control solution!

Businesses can credit check and monitor the companies, automatically chase late payments and collect overdue invoices all in one platform with Check-it, Chase-it and Collect-it.

We’ve also just added Credit Insure-it allowing users insure invoices against the risk of administration or liquidation and Invoice Finance-it giving them the facility to access funding against their unpaid invoices!

Know-it was created to save time and costs by removing the need to access multiple different platforms.

It allows businesses to manage all their credit control functions, all in one place.

Know-it completely automates your credit control process helping businesses to make credit decisions, effectively chase customers for payment, reduce debtor days and increase cashflow all from one convenient platform.