Single Business Credit Reports For Just £10*

- Company Credit Scores & Limits

- Free 12 Months Monitoring

- Financial Performance

- Business Verification

- Directors & Shareholders

- Company Ownership

- Key Risk Indicators

- Download Credit Report As PDF

Your Business Email Address

*Price excludes VAT.

So Much More Than Just A Business Credit Report

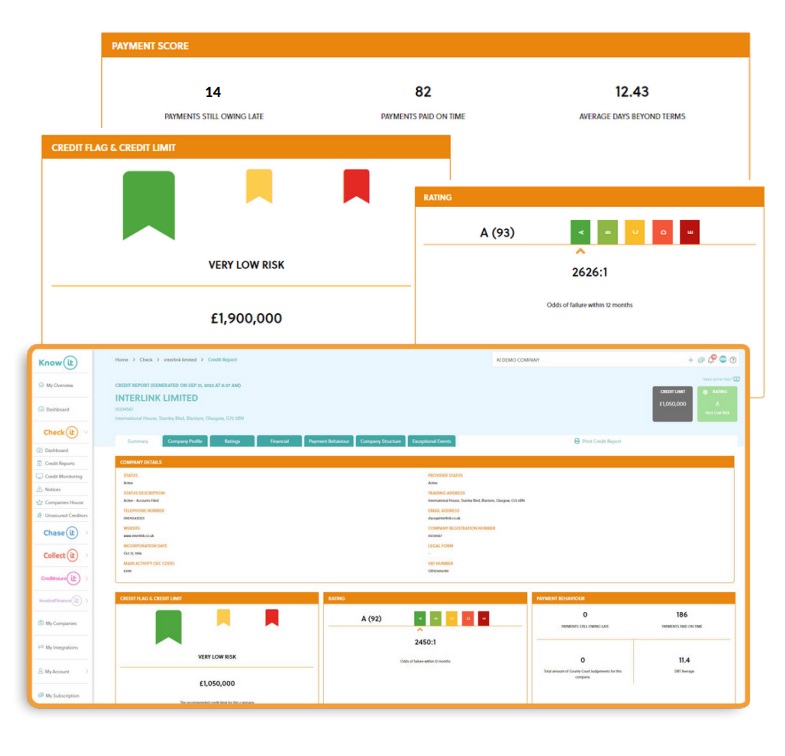

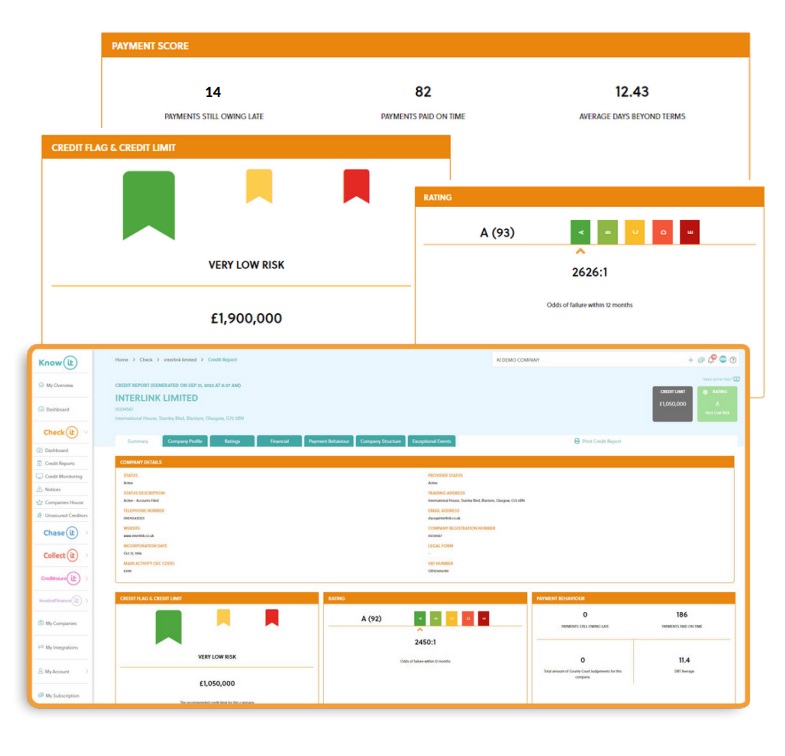

Business Credit Scores & Limits

Clearly see the financial health of your customers with their company credit score and suggested credit limit.

Free 24/7 Monitoring for 12 Months

Know-it automatically monitors your company credit report and instantly notifies you of any changes to credit score or limits.

Financials & CCJs

Get a complete picture of your customers with up-to-date financial information such as late and non-payment as well as any CCJ's on file.

Multiple Data Sources

Credit data from Creditsafe, company info from Companies House and instant notifications for events like administrations, liquidations from The Gazette all in place helps you make more informed credit decisions.

See Losses Suffered By Your Customers

Identify losses suffered by your customers as a result of their own clients going into liquidation or administration.

Our company credit reports are one of the most predictive within the industry and predicts up to 70% of UK failures up to 12 months prior to insolvency.

FAQs

Understanding the likelihood of your customers paying on time is critical for protecting your cashflow.

A company credit report allows you to identify how much of a credit risk your customers pose, gain insight to their payment history, mitigate the risk of late payments, avoid bad debt & get a steer on what credit limit to offer.

A company credit report allows you to identify how much of a credit risk your customers pose, gain insight to their payment history, mitigate the risk of late payments, avoid bad debt & get a steer on what credit limit to offer.

There are a multitude of factors impacting company credit reports including late payments, defaults, CCJs, lines of credit applied for recently and any new lines of credit opened.

Our company credit reports include company ownership details, credit score and rating provided by Creditsafe, recent payment behaviour, financial filings and any events you should be aware of concerning your customer.

We include information from Companies House and The Gazette as well as unique data insights to give a complete picture of your customers financials.

Our data insights identifies financial losses suffered by your customers as a result of their own clients going into liquidation or administration.

Creditsafe is the world’s most used provider of online business credit reports. Data from Creditsafe can help businesses predict almost 70% of all insolvencies up to 12 months in advance.

Credit information provided by Check-it is powered by Creditsafe so you are always making informed credit decisions with the most reliable credit data in the world.

Credit information provided by Check-it is powered by Creditsafe so you are always making informed credit decisions with the most reliable credit data in the world.

Company credit scores and limits are never fixed, they change depending on various different events. You should at a minimum be credit checking every new customer and all existing customers each time they place a new order.

All company credit reports provided by Check-it are automatically monitored for any changes for 12 months. This means you’ll be notified as soon as anything changes without the need for you to request a new credit report.

All company credit reports provided by Check-it are automatically monitored for any changes for 12 months. This means you’ll be notified as soon as anything changes without the need for you to request a new credit report.