Complete Guide To Reading A Business Credit Report

A business credit report is a powerful tool at your disposal that will allow you to get a glimpse into the financial shape of your customers, helping you make smarter credit decisions.

It can also help you identify areas of improvement in your own business that will make you more favourable to lenders and suppliers.

The key metric displayed on a business credit report is a business credit score. Each credit reporting agency will use slightly different scoring criteria and algorithms, but this score will let you know at a glance the credit-worthiness of a company.

A good business credit report will have a ton of useful data to read and analyse, but it can be overwhelming if you don’t know where to start.

That’s why we’ve written this guide to bring you everything there is to know about reading a business credit report in one place!

Before we start, did you know you get a free business credit report when you sign up to Know-it? There’s no cost to sign up, get started today!

What’s included in a business credit report

First, let’s break down everything that’s included in a business credit report!

We’ll use a Check-it business credit report for this example.

The credit data found in Check-it business credit reports come from Creditsafe, the world’s most used provider of online business credit reports.

This is so significant because this credit data can help businesses predict almost 70% of all insolvencies up to 12 months in advance.

- Company details including address, industry with SIC code, company registration number and VAT number.

- Credit flag & credit limit.

- Business credit rating.

- Payment behaviour.

- Key financial figures.

- Company contact details.

- Exceptional events.

- CCJs.

- Insolvencies.

- Losses suffered as a result of their customers going into liquidation or administration.

Now let’s dive in to how you read a business credit report!

How to read a business credit report

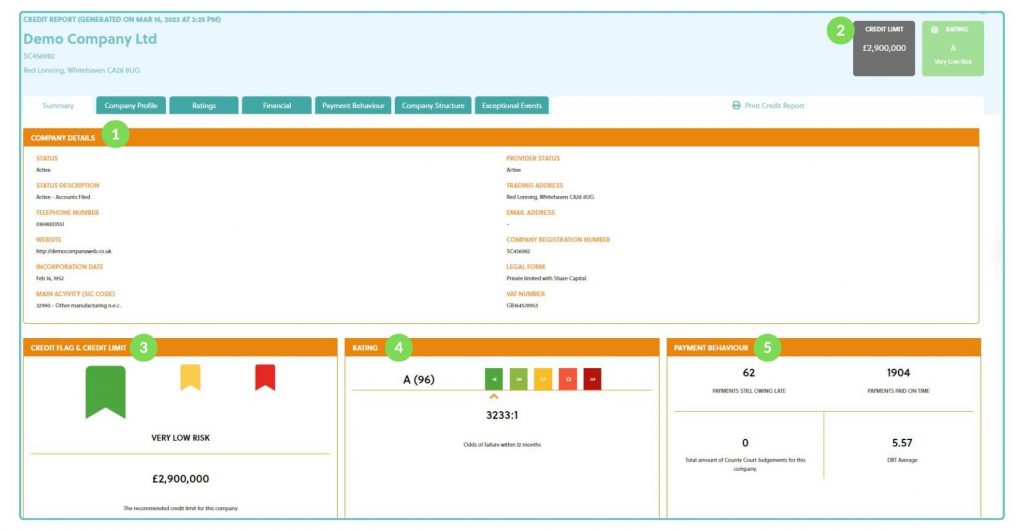

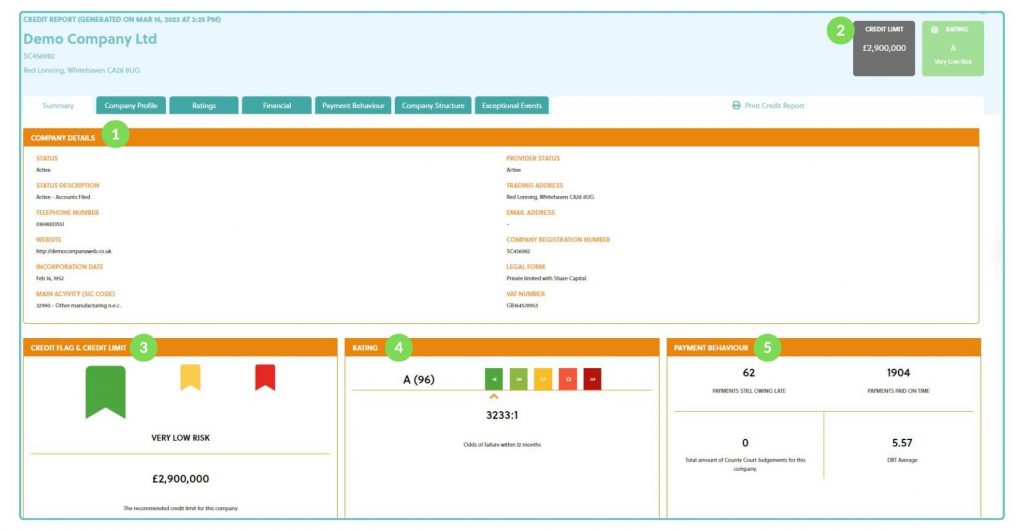

When you open a business credit report with Check-it you’ll see 7 tabs along the top, starting with ‘Summary’. Here we’ve explained how to read the data provided in each tab:

Summary

- Here are the company details of the business you’ve pulled a credit report for. You’ll see if they’re still trading under ‘status’ as well as contact details, website, address, company registration number and VAT number.

You’ll also find their industry and SIC Code. This is particularly relevant as there are industries that pose a higher risk than others! - In the top right of the page you’ll clearly see the credit limit and credit rating of the company. The colour of the rating box is green in this example signalling a very low risk. Medium risk companies will show as orange and high risk will be shown as red.

- The credit flag uses a traffic light system, low risk will show as green, medium risk as yellow and high risk as red. This let’s you see at a glance how much of a credit risk a business could pose to you.

The credit limit is also displayed here. - The credit rating can be found here with the credit score in brackets. You’ll also see the odds of the business failing within 12 months.

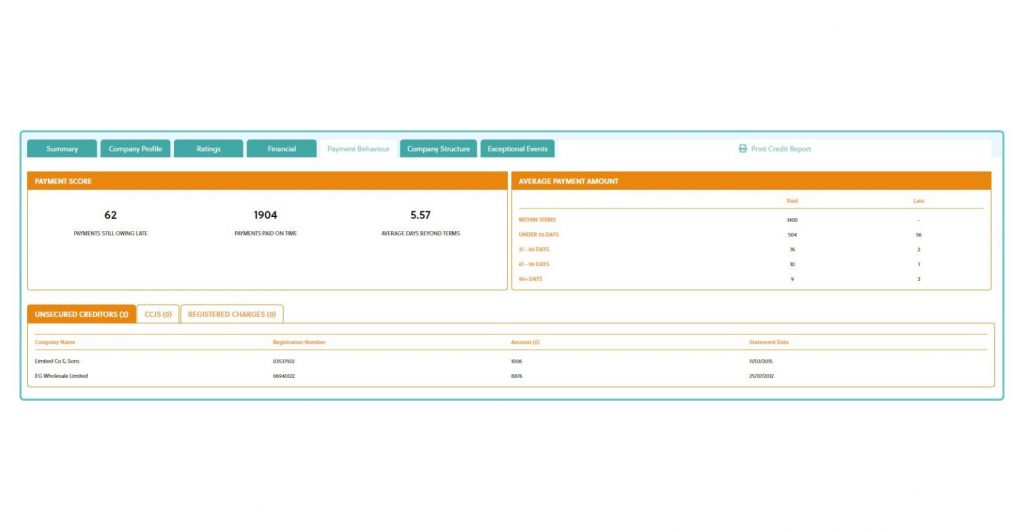

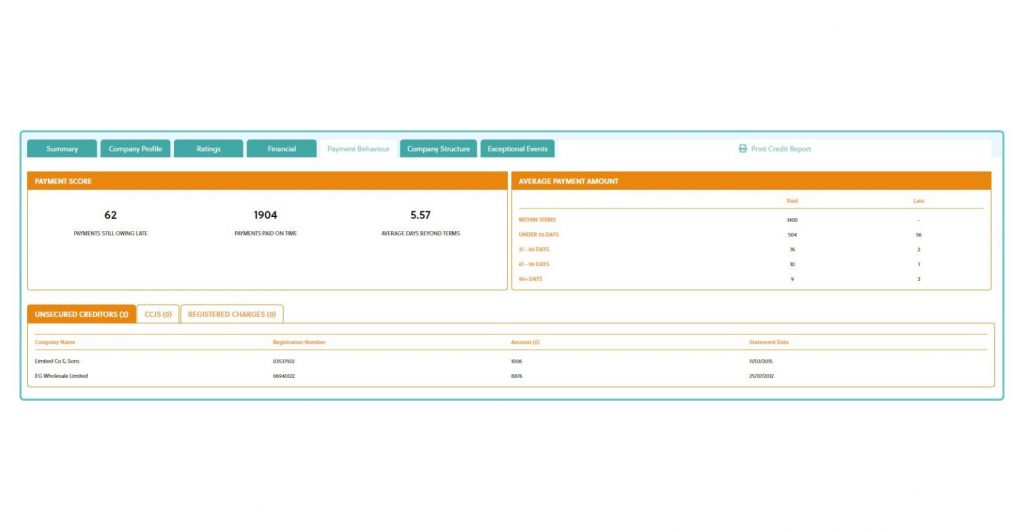

- This critical piece of data shows their payment behaviour. You’ll see how many payments are still owing late and compare these to payments paid on time.

CCJs and their average days beyond terms are also displayed here.

A CCJ (country court judgement) is a type of court order that can be registered if a business fails to repay money owed.

The average days beyond terms gives an indication as to how late payments are usually made. DBT is calculated at +30 days due to the average invoice having payment terms of 30 days.

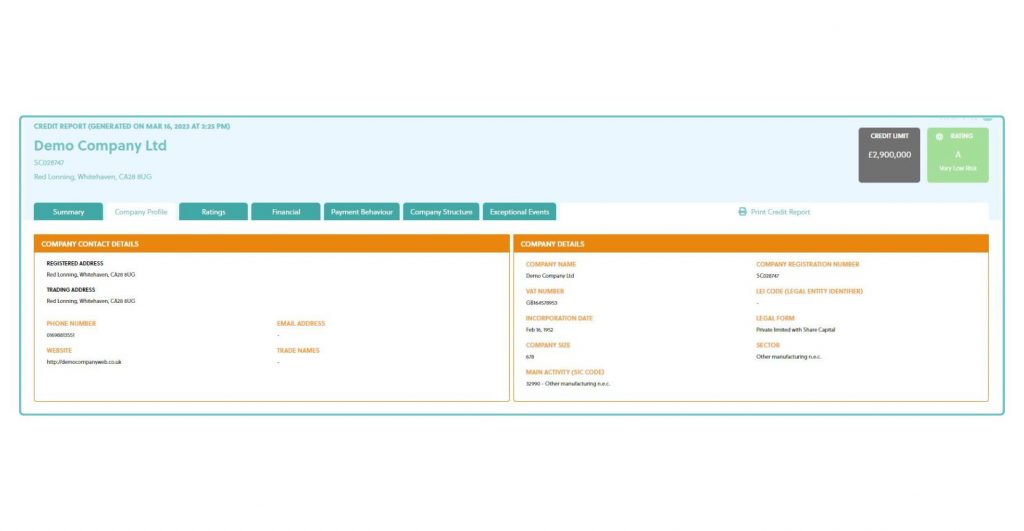

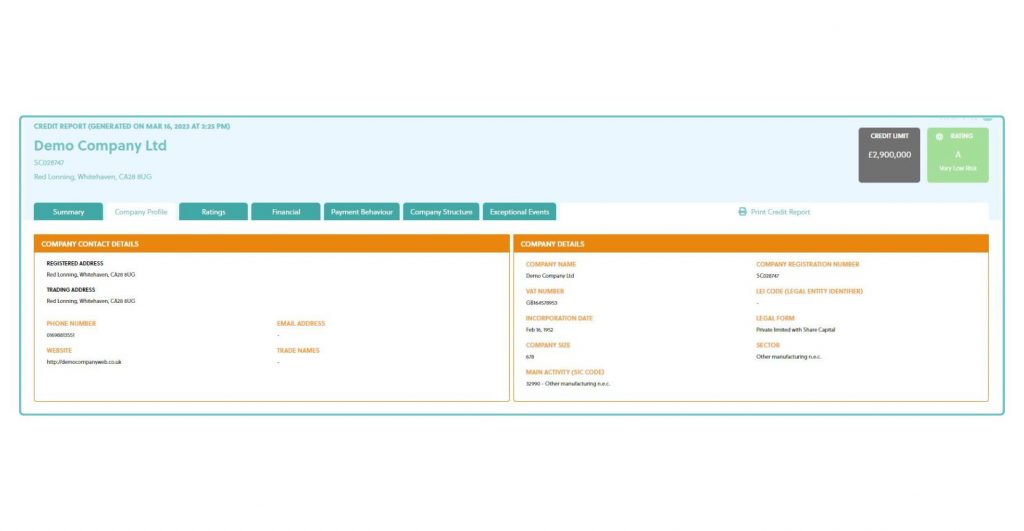

Company profile

Here you’ll see contact and company details all in the same tab!

Ratings

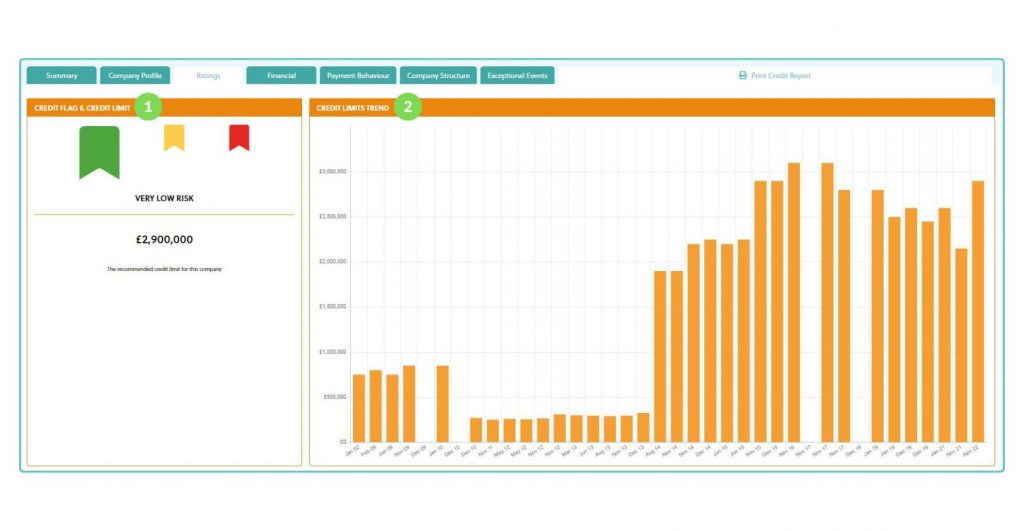

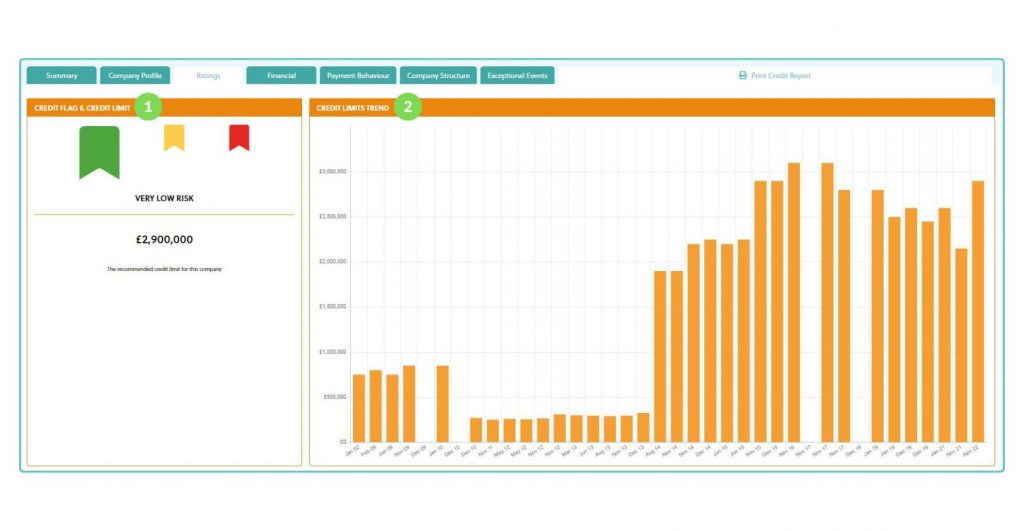

Here you’ll see the credit flag and credit limit again, as well as the credit limits trend over time to give an indication as to how the health of the business’ credit file has been.

Scrolling down you’ll see the credit rating, score and the ratings trend over time. Having data from a longer time period makes the information you’re making a decision from much more reliable!

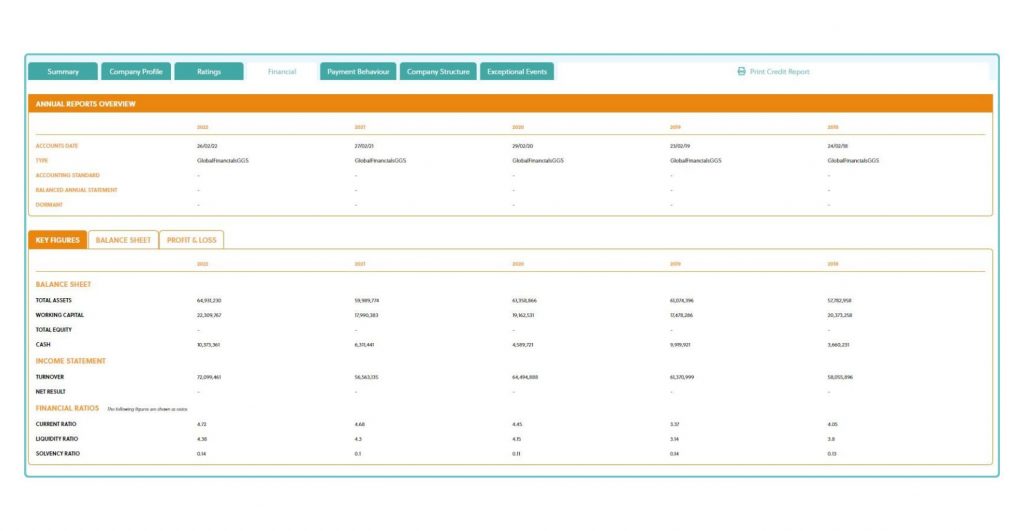

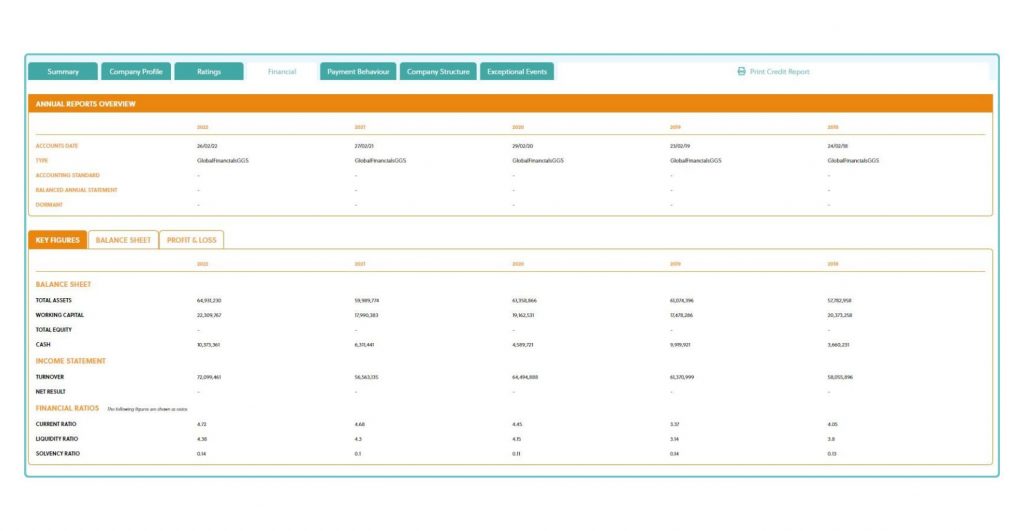

Financial

Here you’ll see the financials that have been published by a business including:

- Annual reports overview.

- Key figures such as turnover, and financial ratios.

- Balance sheet.

- Profit & loss.

Payment behaviour

– Within terms.

– Under 30 days.

– 31 – 60 days.

– 61 – 90 days.

– 90+ days.

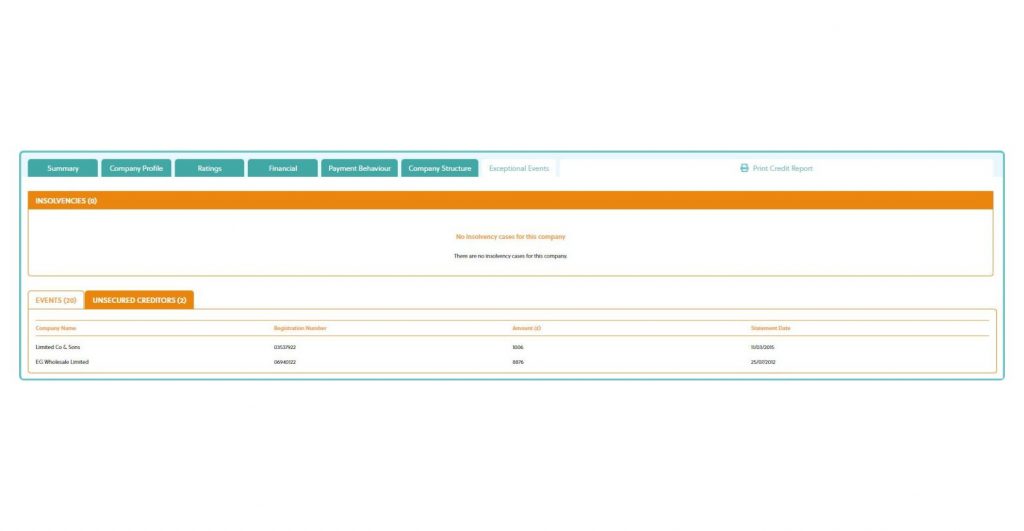

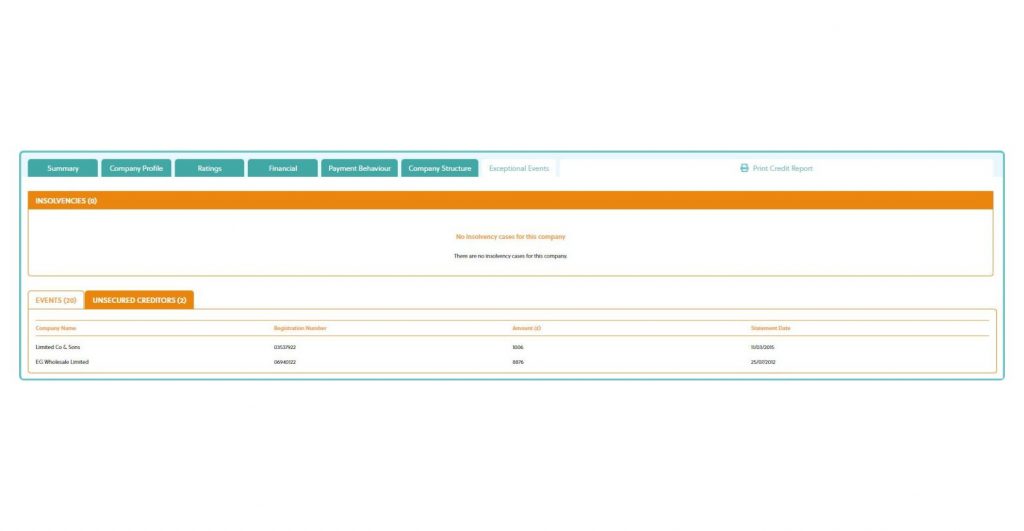

Exceptional events

Here you’ll find all of the events regarding a company that you likely should be aware of as well as any insolvencies.

If a company goes insolvent then your chances of recovering what you’re owed will plumet drastically!

As a bonus we also feature unsecured creditor claims data in our business credit reports. This will allow you to identify losses suffered by a business as a result of their customers going into liquidation or administration.

This unique piece of intelligence not included in other business credit reports will allow you to anticipate a potential cashflow disaster before it arises!

Explaining a business credit score

A business credit score works on a scale of 1-100 and predicts the likelihood that a business’s payment performance for both financial and non-financial trade accounts will become seriously delinquent (90+ DBT) or the business will fail in the next 12 months.

The higher the score, the lower the risk of a business defaulting on a payment.

Address negative impacts & errors on your business credit report quickly

If you’re looking at your own business credit report and notice an issue or error it’s so important that you get these addressed as quickly as possible.

The good thing about checking your own business credit score is that you can check it as many times as you like without it having an impact on your score!

If you’ve defaulted on payments in the past your business credit score could probably do with some care and improvement. We’d recommend paying your overdue balances as quickly as possible. The longer you leave your payments overdue the greater the impact it will have on your score!

On the other hand, if you notice your credit score drop significantly after continuing to make your payments on time there could be an error on your report.

If there are issues with your business credit score they will linger for a while so this is why it’s best to address them ASAP! Here’s how long data stays on a business credit report:

- Trade data: 36 months.

- Bankruptcies: nine years and nine months.

- Judgments: six years and nine months.

- Tax liens: six years and nine months.

- Uniform Commercial Code filings: five years.

- Collections: six years and nine months.

- Bank, government and leasing data: 36 months.

Why you should check & monitor your customers’ business credit scores

Running a business credit check on your customer is the very first thing you should do when accepting an order, both for new and existing clients.

You see, credit scores are constantly changing. A customer you pulled a report on last year could have a drastically different credit score now.

When you pull a business credit report through Check-it the report will automatically be monitored for 12 months, alerting you to any changes in real-time!

Mitigate credit risk

The first step in any effective credit control process is mitigating credit risk, avoiding a cashflow catastrophe before it has time to develop.

A business credit report will give you all the information you need to make an informed credit decision and crucially, give insight to their payment behaviour. If you have a potential customer with a track record of repeatedly missing payments then this will be a major red flag!

Set appropriate credit limits

You’ll also see their credit limit, allowing you to set an appropriate credit limit that will allow you to grant an order and generate revenue whilst also making it affordable for your customer, minimising the risk of payment not being made.

Why you should check & monitor your own business credit score

The principles are very similar here where you’re looking to see how favourable you look to lenders and suppliers when applying for funding or credit for product, machinery, equipment etc.

How much credit you can expect to receive

This will allow you to apply for credit that is both affordable to your business and minimise the risk of having your application for credit rejected.

For example if you know you will likely be accepted for a certain amount of stock or apply for a particular value loan it will allow you to forecast and plan much more accurately.

Perceived financial risk to lenders and creditors

Understanding how you look financially to lenders and suppliers great knowledge to have.

Once you understand what could be letting you down it will allow you address it so you can secure larger orders and funding for expansion in future.

Errors in reporting and potential fraud

Another great benefit is you can cross-match the information provided in your business credit report with your own 1st party data and see any discrepancies and cases of fraudulent activity.

If you ever come across this you should contact the credit reporting agency and alert them to the false information.

Get your free business credit report today!

Sign up to Know-it today for no cost and get a free business credit report!

Know-it automates the complete credit control process allowing businesses to mitigate credit risk, reduce debtor days and boost cashflow.

Start for free today!

See how easy it is to read a Check-it business credit report with this short video!

Lynne is the Founder and CEO of Know-it!

She is a passionate, driven and forward-thinking entrepreneur determined to help resolve the late payment crisis gripping SMEs.

Having worked within the credit management industry for over 27 years and ran UK leading commercial debt recovery specialists Darcey Quigley & Co for over 16 years, Know-it was devleoped to make credit control more accessilble for SMEs to help them effectively mitigate credit risk, reduce debtor days and boost cashflow!

Connect with me on LinkedIn!