What Is Invoice Finance & How Does It Work?

Invoice finance is a fantastic way to get a quick injection of cash to your business when you need it!

Has there ever been a time when you’ve been in a tough spot waiting for your overdue invoices to be paid?

It’s a familiar situation too many businesses are finding themselves in.

Invoice finance is a service that alleviates the stress of waiting for your invoices to be paid so you can pay your own expenses, protect your cashflow or invest in growing your business.

With invoice finance you essentially use your unpaid invoices as security against funding, very similar to a loan.

A big difference though is you don’t need to make any repayments until your client pays the invoice you’ve used as collateral! This presents an extremely flexible way of accessing finance for your business.

Reasons to consider using invoice finance

Invoice finance can be a lifeline to businesses struggling as a result of waiting for invoices to be paid.

We’re currently in the midst of a late payment crisis that’s crippling SMEs in the UK.

At the end of last year it was reported that late payments for small businesses had hit a two-year high!

UK businesses are currently chasing £61 billion worth of late invoices so if you’re having difficulties waiting for payment you’re not alone, and invoice finance could be a great solution for you:

- Get a much-needed injection of cash quickly to pay urgent overheads or invest back into your business for growth.

- Accessibility – this type of funding is available for most businesses who meet some basic criteria, more on that below!

- Flexibility – There’s no regular repayments, you only pay back the lender once you’ve had your invoice paid by your client.

- Scalable – Borrow more funds as you issue larger invoices. This means the cash you have access to will grow as your business grows.

- Security – As your unpaid invoices are your collateral you don’t need to place any other assets at risk.

- Speed – The time taken to approve invoice finance tends to be far quicker than other ways of borrowing such as taking out a business loan.

How does invoice finance work?

The speed that you can access funds is key here and the process of invoice financing that makes it work!

You’ll submit your unpaid invoice to a lender offering invoice finance and they’ll provide you with a percentage of the invoice value, typically between 75% and 95% of the total value depending on certain criteria you provide during your application.

You would then make the repayment to the lender once your invoice has been paid by your client.

In this instance you are the one responsible for getting your invoice paid and all credit control will be down to you in order to make the repayment.

A trust account is then set up by the invoice finance provider, but it will look like one of your own accounts to your customer.

You’ll then need to instruct your customer to make payment to this account. The invoice finance provider will then take away any interest and fees you’ve agreed to and transfer the remaining value into your own account.

The brilliant thing here is confidentiality – your customer will never know that they’ve paid into a trust account so won’t know your borrowing history!

What are the different types of invoice financing available?

You might’ve seen different types of invoice financing – invoice factoring and invoice discounting.

So, what’s the difference?

What is invoice discounting?

Invoice discounting is typically the product discussed when the term “invoice finance” is used.

You keep full control of your sales ledger and are responsible for collecting your unpaid invoice to repay your loan. The invoice finance provider will then deduct interest and fees before passing over the remaining amount to you.

What is invoice factoring?

This is similar in the sense you’re borrowing against your unpaid invoices, but with invoice factoring the lender will take control of your sales ledger and collect payment directly from your customers.

They’ll then deduct a factoring charge and pass you the remaining balance.

Are you eligible for invoice finance?

The eligibility criteria for invoice finance is quite wide and presents the perfect way of securing funding for many businesses across the UK.

As long as you fit the following you’ll be eligible to use Invoice Finance-it from Know-it!

- Invoice other businesses, not consumers.

- Have a minimum £30,000 annual turnover.

- Get paid by invoice with minimum credit terms of 14 days.

Implementing invoice finance into your credit control process

Hopefully now you have a good understanding of what invoice finance is and if it’s a good fit for your business needs.

If you’re eligible for invoice finance we’d definitely recommend including it in your credit control process!

Having a back-up for keeping a healthy cashflow in the event you’re not paid on time will be absolutely critical for your business as we navigate 2023 and a recession expected to last until the end of 2023!

The foundations of a solid credit control process remain the same:

- Run thorough company credit checks and monitor for changes.

- Be proactive sending payment reminders and chasers.

- Have a plan for collecting commercial debts.

- Have other options for a quick cash injection in place in the event of non-payment, such as invoice finance.

Save time on credit control with automation!

Following an effective credit control process can be extremely time-consuming, with some businesses employing full teams just for credit management.

However, it is one of the most critical functions in a business.

What’s the point in carrying out work or providing goods if you’re not getting paid for it?

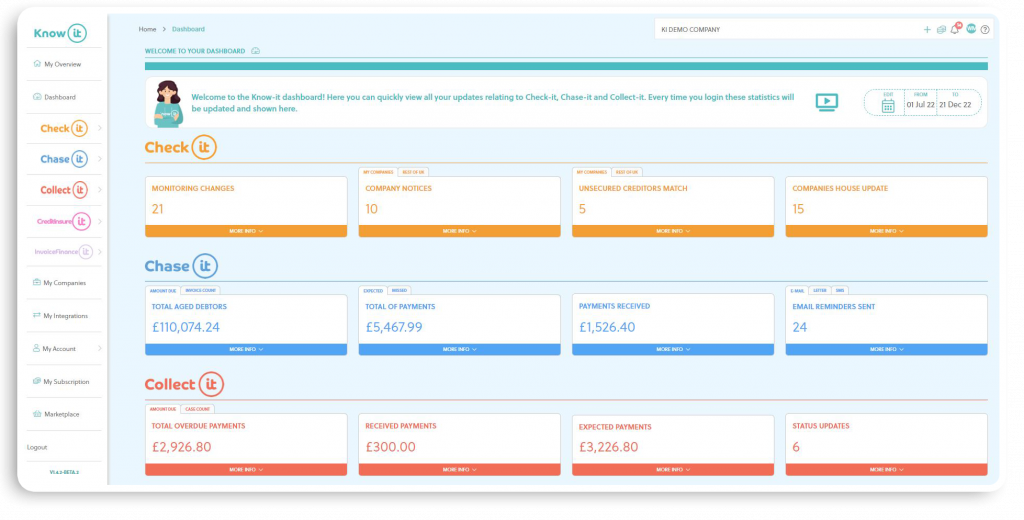

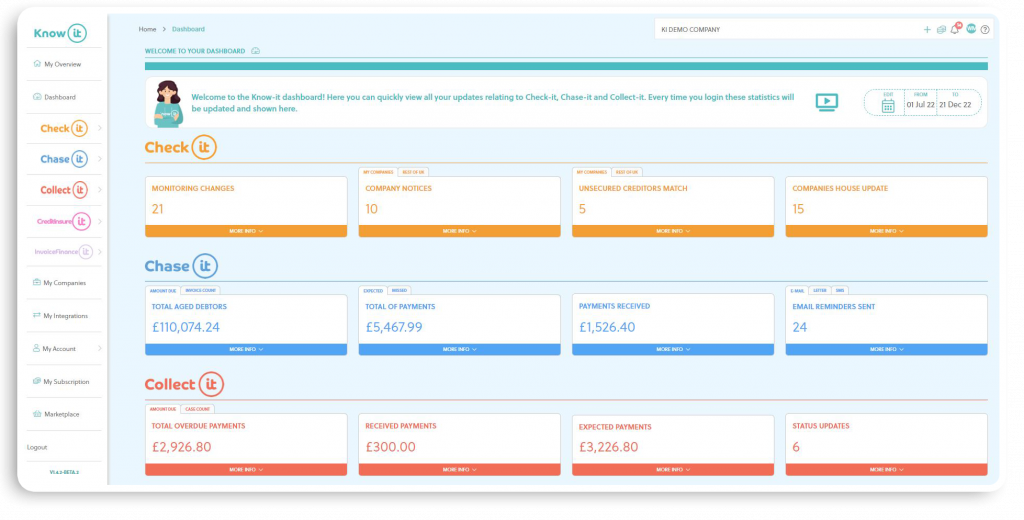

Know-it automates the complete credit control process, making credit management more accessible for businesses of all sizes.

And best of all, it’s FREE to sign up!

Know-it is an all-in-one credit control solution allowing you to credit check and monitor companies, automatically chase payments, collect overdue invoices and more all in one place!

You’ll have access to five critical credit control tools all in one platform:

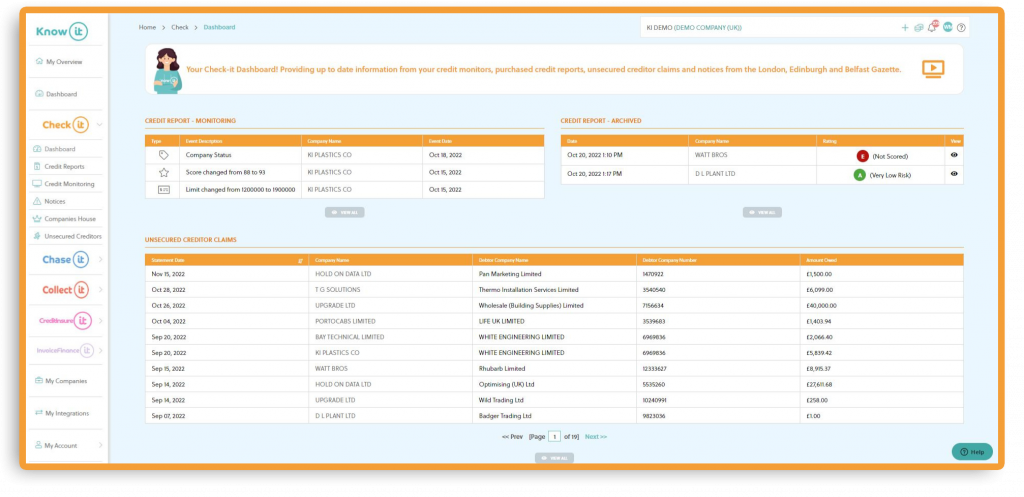

Check-it

Check-it allows you to make better credit decisions with real-time credit data from Creditsafe and company information from Companies House, The Gazette & unique data insights.

With automatic monitoring you’ll always be notified of changes to your customer’s credit report!

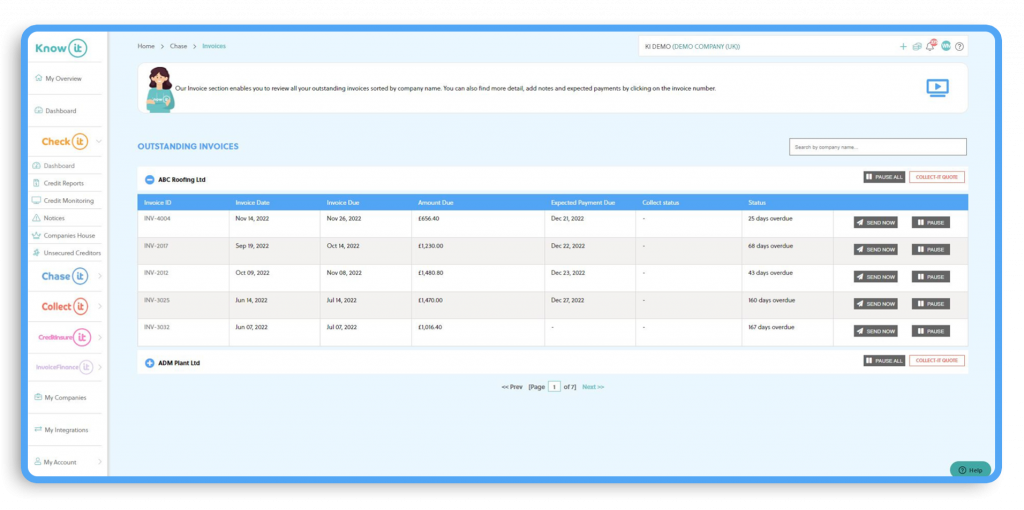

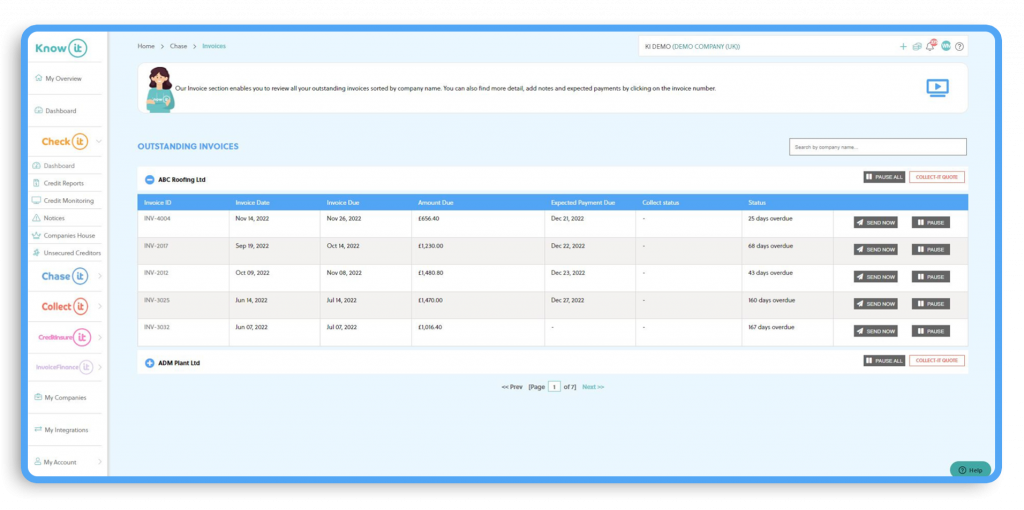

Chase-it

Automate the payment chasing process, allowing you to schedule payment reminder emails, letters and SMS messages with fully customisable templates.

Seamlessly integrate your Xero, Sage, QuickBooks or FreeAgent account to automatically chase payments!

Our Microsoft 365 integration means you can send chasers from your own inbox.

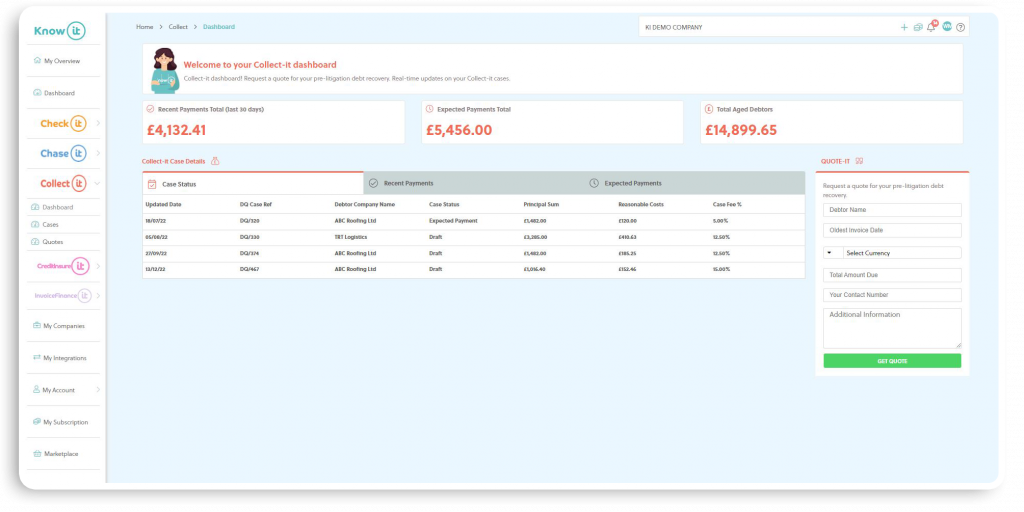

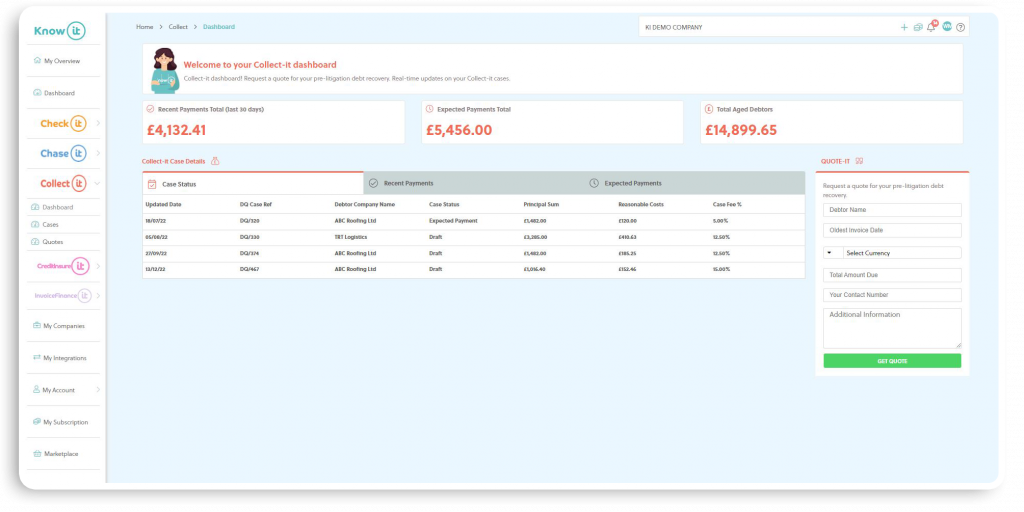

Collect-it

Receive instant quotes to collect your unpaid overdue invoices through our pre-litigation recovery partner, Darcey Quigley & Co.

Stay up to date with real-time case updates, receive instant quotes for recovery and only pay a fee if your debt is collected!

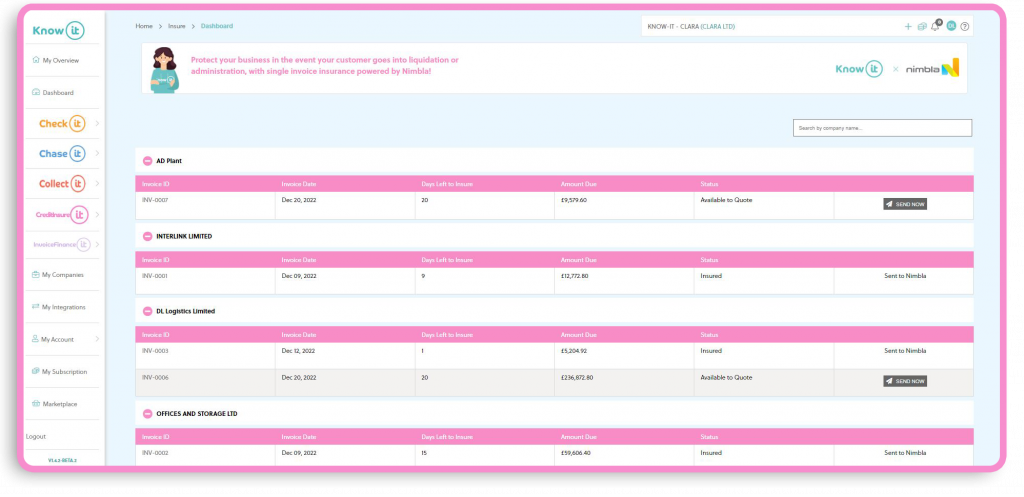

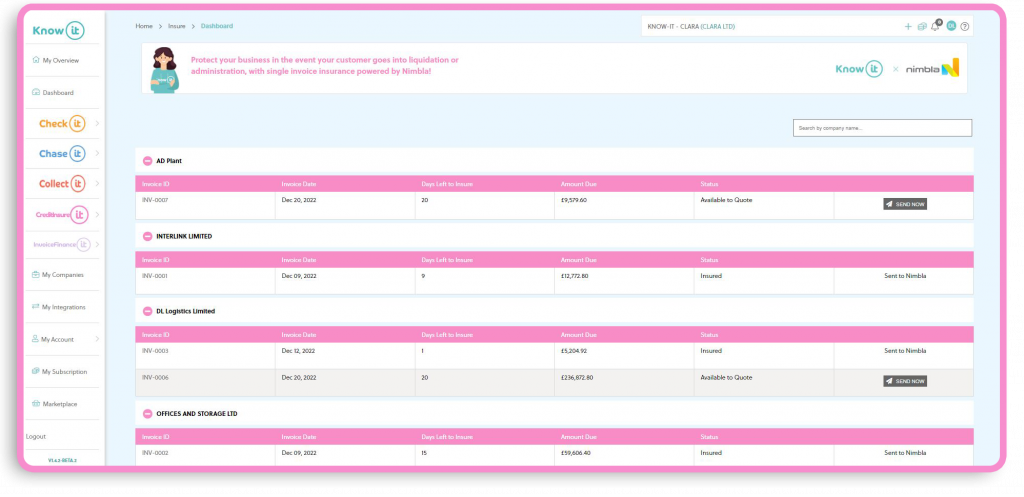

Credit Insure-it

Protect your business in the event your customer goes into liquidation or administration.

Getting a quote is quick and easy and insuring select invoices is more cost-effective than traditional credit insurance!

Find out what trade credit insurance is and how it works here!

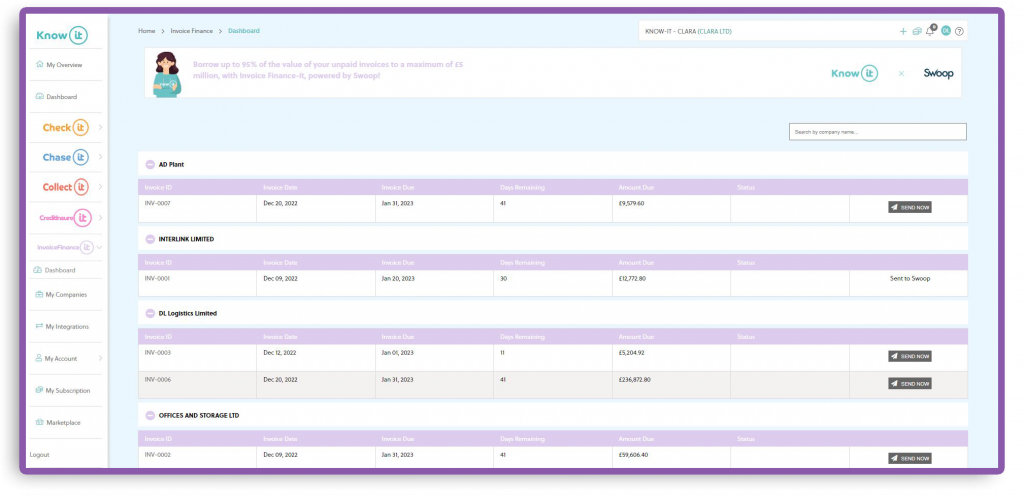

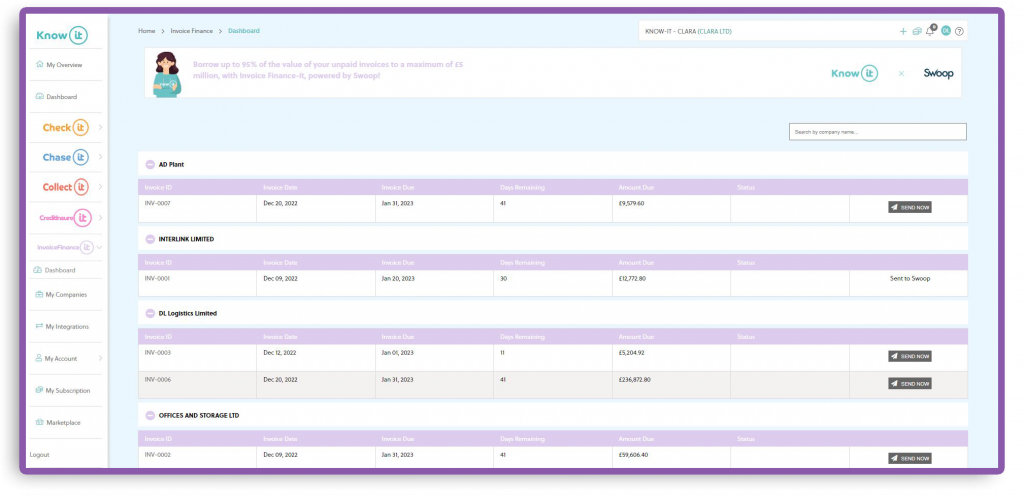

Invoice Finance-it

Find the funds to cover invoice payments easier and faster than before.

Give your cashflow a nice boost instead of waiting to be paid by borrowing against your outstanding invoices.

Get all of the above in a single platform, what are you waiting for? Be-A-Know-it-all!

Learn more about Invoice Finance-it below!

Lynne is the Founder and CEO of Know-it!

She is a passionate, driven and forward-thinking entrepreneur determined to help resolve the late payment crisis gripping SMEs.

Having worked within the credit management industry for over 27 years and ran UK leading commercial debt recovery specialists Darcey Quigley & Co for over 16 years, Know-it was devleoped to make credit control more accessilble for SMEs to help them effectively mitigate credit risk, reduce debtor days and boost cashflow!

Connect with me on LinkedIn!