What Is Trade Credit Insurance & How Does It Work?

Trade credit insurance provides much needed protection against the risk of your customers going into liquidation or administration!

Think about the companies on your sales ledger and their average order value, could you afford for some of them not to be able to pay you as a result of going insolvent?

In 2022 the number of registered corporate insolvencies soared 56% to 23,180 in England, Scotland and Wales and Creditors’ Voluntary Liquidations (CVLs) spiked 51% year-on-year.

Things could also get a lot worse with The British Chambers of Commerce (BCC) forecasting that the economy won’t return to growth until Q4 2023.

With this in mind it’s never been so important to give your cashflow an extra layer of protection!

Trade credit insurance allows you to insure single invoices to ensure you’re still paid even if your customers go insolvent and can’t pay their invoices themselves.

Reasons to consider using trade credit insurance

There are many reasons to consider trade credit insurance due to the huge benefits they can bring, particularly during the turbulent times businesses are facing right now.

Protect your cashflow

Protecting cashflow should be a key priority for businesses, especially as we navigate a recession.

Trade credit insurance is here in the event your customers fail to pay their invoices due to administration or liquidation.

Improve your access to cash

Having access to multiple routes of cash at your disposal is critical to keeping your business ahead, and trade credit insurance gives you another way to access cash quickly, often at competitive rates!

Reduce business risk

Mitigating risk to your business is key to survival and growth.

By protecting your business against the risk of your customers going into administration or liquidation you are eliminating a risk to your cashflow.

Accessible and flexible option to access funds

The facility to insure single invoices makes trade credit insurance accessible to many SMEs who would previously have been unable to insure their whole sales ledger or insure against their annual turnover.

Insuring single invoices makes this type of trade credit insurance much more appealing to businesses who only need to insure against particular customers they deem as “high-risk” or invoices with a value over a certain amount.

Increased trading confidence

Knowing you have protection in place your business will be able to trade more confidently, accepting larger orders and taking on more clients.

Growth and expansion into new markets

As you trade with more confidence, issuing larger invoices, growth such as entering new international markets will become more accessible.

Insuring your invoices will greatly mitigate the risks of trading overseas.

Protect customer relationships

Having the freedom to trade more confidently will allow you to protect your customer relationships by fulfilling larger orders for your existing client base.

Improved banking terms

Banks and financial institutions will offer better banking terms to businesses that have trade credit insurance in place, because this provides greater protection to their assets.

Your business will be able to borrow more, usually with a preferential rate.

Reduce bad debt reserves

With trade credit insurance you’re able to free up some capital that would otherwise be set aside in the event your invoices aren’t paid.

This cash can be used to reinvest into your business to grow!

Trade credit insurance is discreet

Your clients won’t know that you’ve decided to insure their invoices.

How does trade credit insurance work?

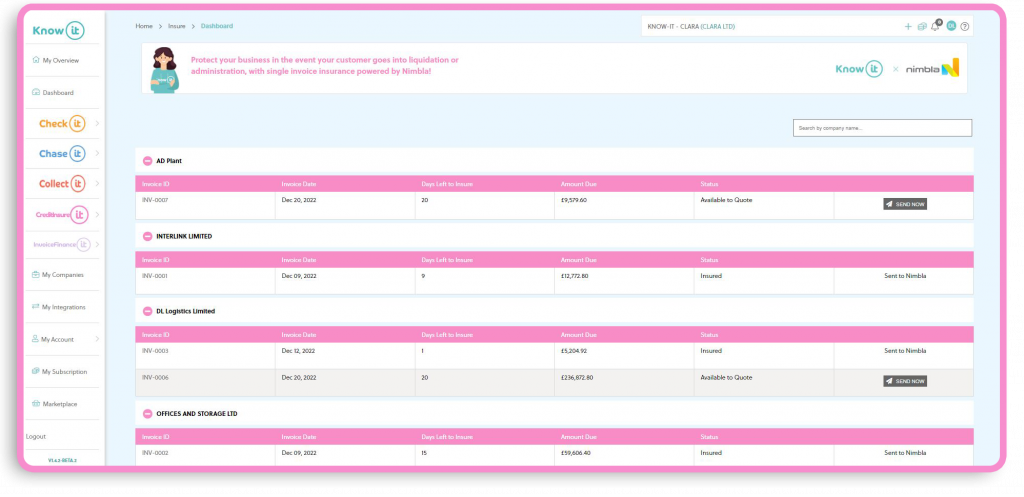

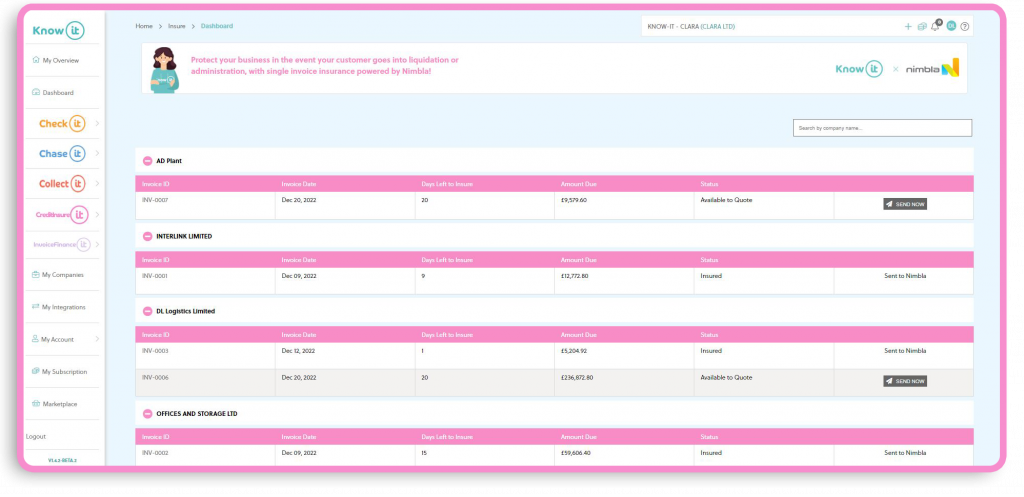

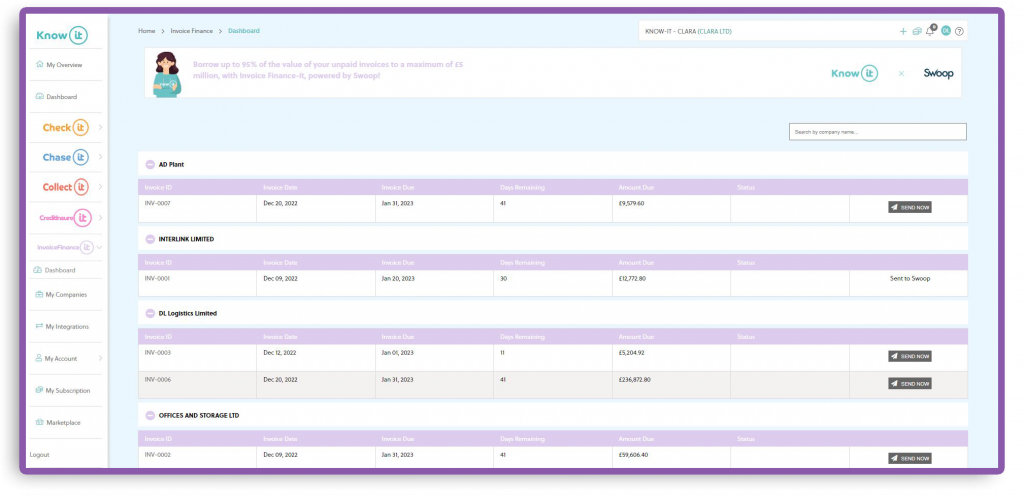

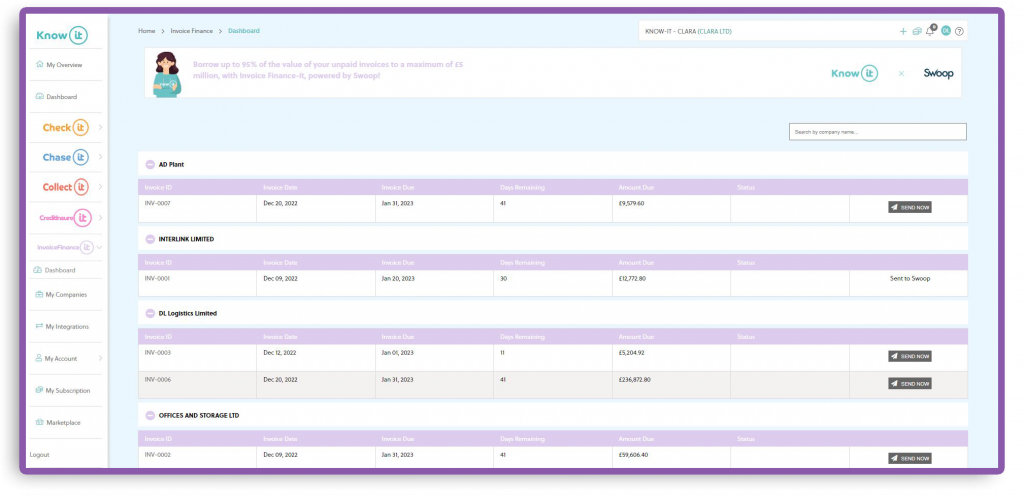

Trade credit insurance offered with Credit Insure-it allows you to select the individual invoices you’d like to insure using our sleek and easy to use platform.

Simply choose the invoice you’d like to protect in the event of liquidation or administration.

From here your credit insurance will be handled by our partner Nimbla, taking the risk out of trading on credit terms.

If you customer becomes insolvent before they pay your outstanding invoice, your credit insurance policy will pay 90% of your invoice value, protecting your cashflow!

The process is seamless and straight-forward. You’ll receive an instant quote on the invoices you select for trade credit insurance.

Are you eligible for trade credit insurance?

Single invoice trade credit insurance is more accessible than ever and the criteria will help millions of SMEs in the UK protect their cashflow in the event their clients go into administration or liquidation.

Here’s a list of the criteria businesses need to be eligible for trade credit insurance using Credit Insure-it.

• Your client needs to be based in the UK.

• Your client needs to be a LLP or Limited Company.

• Your client can be a registered business in the UK or Europe.

• You can insure invoices up to a value of £500,000.

• You invoice must have payment terms up to 120 days.

• You invoice needs to be within the first half of payment terms to be insured.

As long as you insure your invoice early there’s an extremely high likelihood that you’ll be covered!

With prices starting from just £5.60 it really is a no-brainer for peace of mind that your cashflow is protected in case your client goes insolvent.

Implementing trade credit insurance into your credit control process

Having trade credit insurance is just one part of a watertight credit control process!

There are steps that come before and after that will not only help protect your cashflow but also allow you to mitigate credit risk and make smarter credit decisions, reduce the amount of time you wait to be paid, recover invoices faster and actually boost your cashflow.

You see, it’s the businesses that manage their credit control effectively that will thrive as we navigate tricky waters through 2023 amidst hiked interest rates, a shrinking economy and an inferno of company insolvencies.

Streamline your credit control process and save time!

Putting a solid credit control process in place might sound:

- Expensive

- Time consuming

And to be honest, not too long ago you’d have been correct in thinking this.

But these are precisely the barriers we’ve eliminated with Know-it, the all-in-one credit control solution.

Credit control should never be neglected, but it often is because of the barriers mentioned above.

Unfortunately, it’s one of those things that businesses don’t realise they need, until they encounter issues with late payers and cashflow becomes a big problem.

Know-it brings together 5 key elements of an effective credit control process into one simple to use platform, eliminating the need for 5 different tools and subscriptions.

And best of all, it’s free to use!

Here’s what you’ll get:

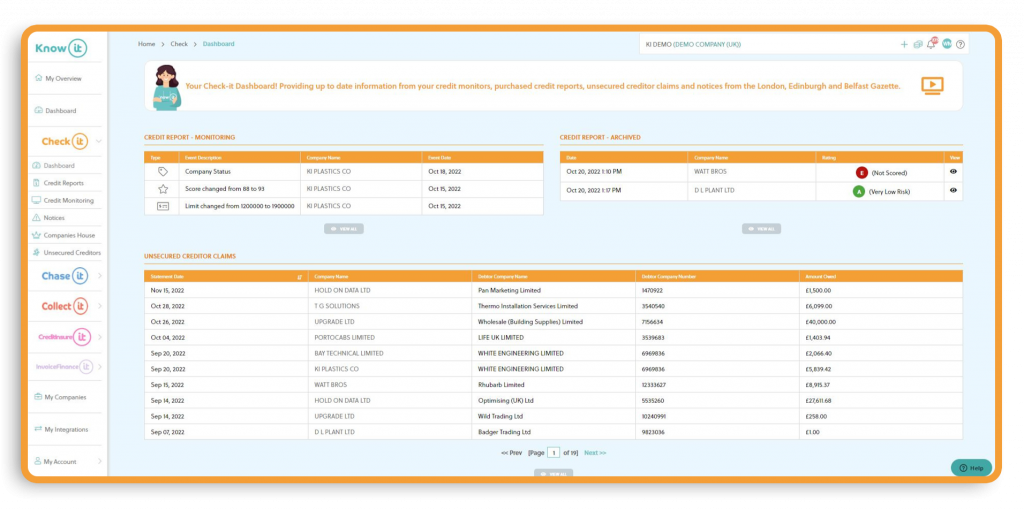

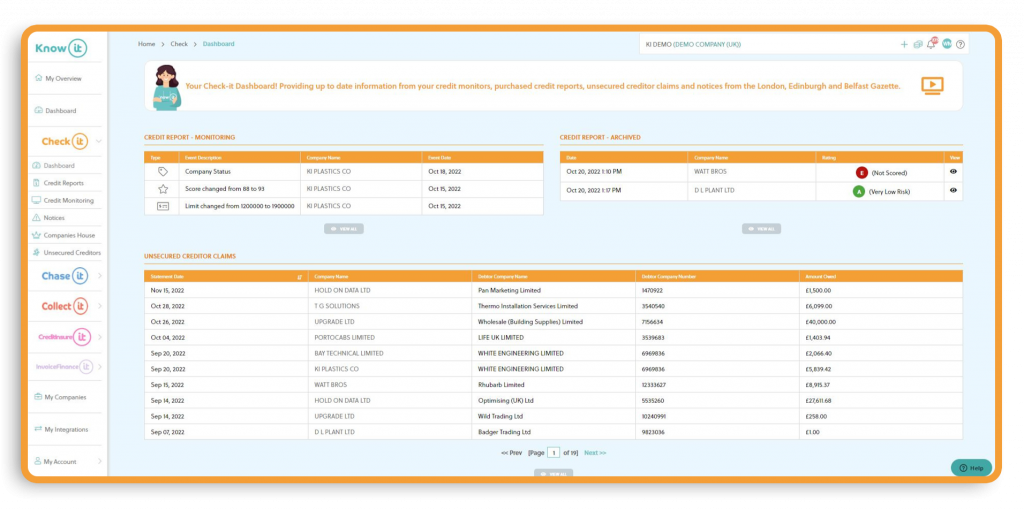

Check-it

Make more informed credit decisions using real-time credit data from Creditsafe, company information from Companies House and notices such as administrations from The Gazette.

Not only that, our unique data insights tell you which of your customers have suffered losses as a result of their own clients going into administration or liquidation, allowing you to spot a potential cashflow catastrophe well in advance!

Oh and did we mention when you pull a company credit report we’ll automatically monitor it for 12 months and notify you instantly to any changes.

What are you waiting for? Get a free company credit report now!

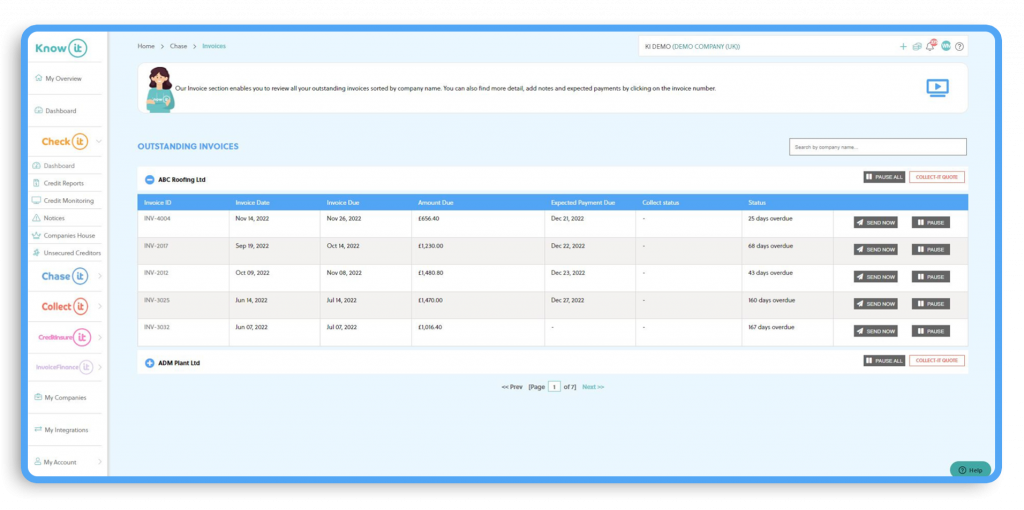

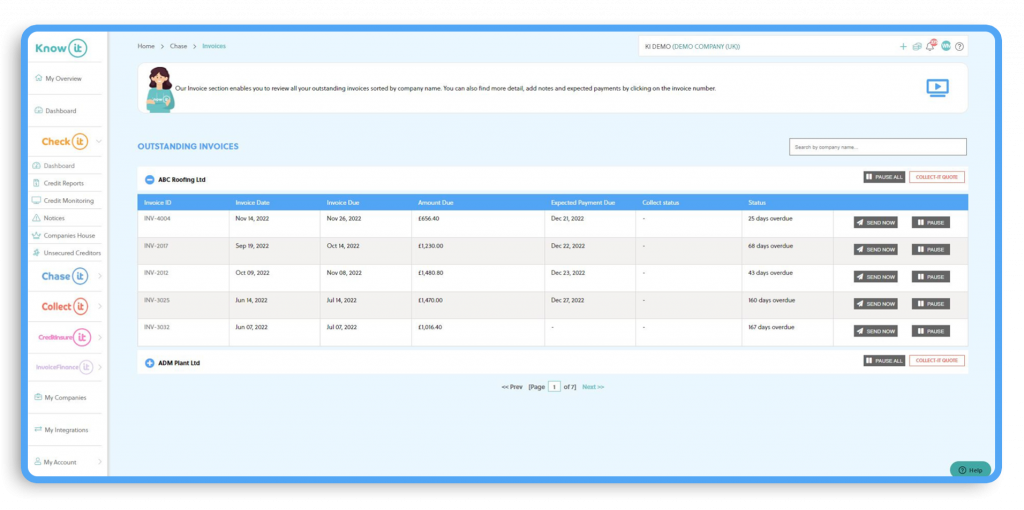

Chase-it

Automatically chase late payments with emails, SMS and letters using your own schedule and customised templates with Chase-it!

Seamlessly connect your Xero, Sage, QuickBooks or FreeAgent account in seconds, set your schedule and payment reminders and chasers will go like clockwork. It’s that easy.

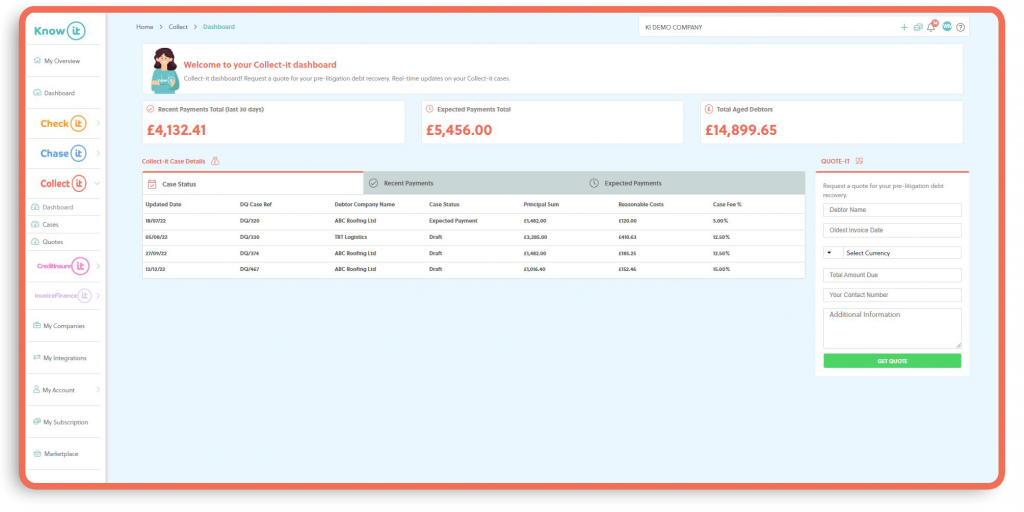

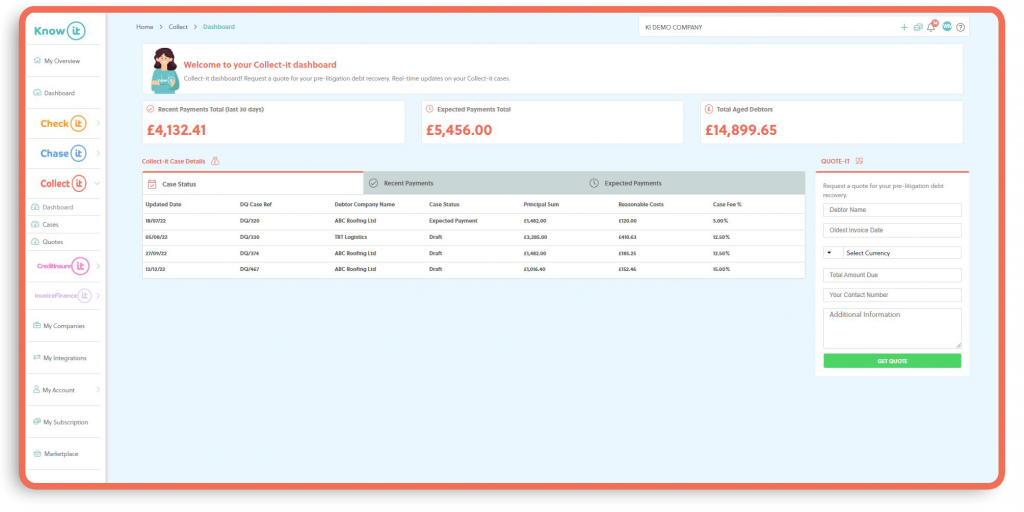

Collect-it

Receive instant quotes to collect your unpaid overdue invoices through our pre-litigation recovery partner, Darcey Quigley & Co.

Stay up to date with real-time case updates, receive instant quotes for recovery and only pay a fee if your debt is collected!

Credit Insure-it

Protect your business in the event your customer goes into liquidation or administration.

Getting a quote is quick and easy and insuring select invoices is more cost-effective than traditional credit insurance. Credit Insure-it is powered by Nimbla.

Invoice Finance-it

Find the funds to cover invoice payments easier and faster than before.

Give your cashflow a nice boost instead of waiting to be paid by borrowing against your outstanding invoices. Invoice Finance-it is powered by Swoop.

Find out what invoice finance is and how it works here!

Get all of the above in a single platform, what are you waiting for? Be-A-Know-it-all!

Lynne is the Founder and CEO of Know-it!

She is a passionate, driven and forward-thinking entrepreneur determined to help resolve the late payment crisis gripping SMEs.

Having worked within the credit management industry for over 27 years and ran UK leading commercial debt recovery specialists Darcey Quigley & Co for over 16 years, Know-it was devleoped to make credit control more accessilble for SMEs to help them effectively mitigate credit risk, reduce debtor days and boost cashflow!

Connect with me on LinkedIn!