Complete Guide To Credit Control For Business

Download this guide as a pdf as well as our other resources for free here!

Credit control is a vital aspect of financial management for businesses.

It involves managing credit sales and making informed credit decisions, ensuring timely payment from customers, and minimising bad debt.

This guide provides a comprehensive overview of credit control practices and strategies that your business can implement to mitigate credit risk, reduce debtor days and boost cashflow!

1. Setting Up Credit Control Processes

1.1 Define Credit Policy:

A well-defined credit policy is the foundation of effective credit management for any business.

It outlines guidelines and procedures for granting credit to customers, setting payment terms, and managing credit risk.

A credit policy sets clear expectations and standards for extending credit to customers and it helps maintain consistent credit practices across the organisation.

A well-designed policy minimises the risk of bad debts and cash flow issues and also serves as a reference for employees involved in credit decisions and collections.

Key Elements of a Credit Policy:

- Credit criteria: Define the requirements and evaluation process for granting credit to customers, considering factors such as credit history, financial stability, and industry reputation.

- Credit limits: Establish limits based on customer creditworthiness, sales volume, and potential risk exposure.

- Payment terms: Determine the acceptable payment periods, such as 30 days, 60 days or other variations.

- Late payment penalties: Specify the consequences for late payments, including late payment interest charges, penalties, or suspension of credit privileges.

- Credit terms and conditions: Clearly communicate expectations regarding payment methods, discounts, warranties, and any other relevant terms.

1.2 Business Credit Checks:

In the world of business, credit plays a pivotal role in determining financial stability and growth.

Just as individuals have personal credit scores, businesses have their own credit profiles that showcase their creditworthiness and financial health.

This is where business credit checking comes into play. Business credit checking is the process of evaluating and assessing the creditworthiness of a business entity.

It provides invaluable insights into the financial history, payment habits, and risk potential of a company, allowing creditors, suppliers, and partners to make informed decisions.

Understanding Business Credit:

Business credit refers to the ability of a company to obtain financing or secure goods and services based on its reputation for paying debts and meeting financial obligations.

Unlike personal credit, which is tied to individuals, business credit is linked to the entity itself.

Building a strong credit profile involves establishing relationships with creditors, maintaining consistent payment patterns, and managing financial obligations responsibly.

Importance of Business Credit Checking:

Risk Assessment and Decision-Making:

Business credit checking is essential for evaluating the risk associated with extending credit to a particular business.

Creditors and suppliers can use this information to determine whether a company is likely to pay its bills on time and honour its financial commitments.

By assessing the creditworthiness of potential business partners, lenders can make informed decisions about extending loans or credit lines.

Similarly, suppliers can evaluate the risk of late payments or default, allowing them to set appropriate credit terms.

Financial Health Evaluation:

Business credit reports provide a snapshot of a company’s financial health.

They contain information about credit utilisation, payment history, outstanding debts, and public records such as bankruptcies or liens.

Examining these details enables stakeholders to assess the financial stability and viability of a business.

It can also uncover warning signs that may indicate potential financial distress or the need for closer scrutiny before entering into any business relationship.

Supplier Selection and Negotiation:

Business credit checking empowers businesses to make informed decisions when selecting suppliers and negotiating trade terms.

By evaluating the creditworthiness of potential suppliers, companies can minimize the risk of disruptions caused by non-delivery or bankruptcy.

Additionally, businesses can negotiate better payment terms or discounts based on their own creditworthiness, thereby improving cashflow and enhancing profitability.

Fraud Prevention:

Business credit checking can help uncover fraudulent activities and protect businesses from potential scams.

By verifying the financial standing of companies before engaging in any transactions, you can mitigate the risk of working with fraudulent or unreliable entities.

This is particularly crucial for businesses involved in high-value transactions or partnerships where the financial stakes are significant.

Get a free business credit report!

Sign up to Know-it for free and get a business credit report immediately!

1.3 Credit Terms and Conditions:

Establishing clear and well-defined credit terms and conditions is crucial for businesses that extend credit to their customers.

These terms outline the expectations, obligations, and rights of both parties involved in a credit transaction.

Well-crafted credit terms and conditions not only protect your business’s financial interests but also foster transparency, trust, and mutually beneficial relationships.

It’s critical you clearly communicate credit terms and conditions to customers in writing.

Include information on payment due dates, late payment penalties, and any discounts or incentives for early payment.

2: Credit Monitoring and Control

2.1 Invoicing and Statements:

Efficient and effective invoicing and statement practices are essential for maintaining healthy financial relationships between businesses.

Clear, accurate, and timely communication regarding payments and financial obligations contributes to smoother transactions, improved cashflow, and stronger partnerships.

Utilise Electronic Invoicing:

In the digital age, electronic invoicing has become the preferred method for sending invoices and statements.

Emailing invoices as PDF attachments or utilising online invoicing platforms not only saves time and reduces costs but also ensures faster delivery and improved record-keeping!

Electronic invoicing allows for easy tracking, archiving, and searchability, simplifying accounting processes for both you and your customer.

Include Essential Information:

Ensure that your invoices and statements contain all the necessary information to facilitate efficient payment processing.

Include your business name, address, contact details, and VAT number where applicable. Specify the invoice number, date, and payment due date prominently.

Next you’ll need to itemise each product or service provided, including quantities, rates, and applicable taxes.

Clearly state any terms or discounts, and provide payment instructions, such as preferred payment methods and account details.

Maintain a Professional Format:

Create a professional and consistent template for your invoices and statements.

Incorporate your business logo, colours, and branding elements to reinforce your identity.

Use a clear and readable font, and organise information in a logical and structured manner.

Ensure that the layout is intuitive, making it easy for the recipient to understand and process the information. Most invoices follow a very similar layout so you can easily use a tried and tested invoice template.

Personalise Communication:

While maintaining a professional format, consider personalising your communication.

Address the recipient by name and include a brief but friendly message to foster a positive relationship.

A personalised touch demonstrates that you value your business relationship and encourages prompt attention to the invoice or statement.

Clearly Communicate Payment Terms:

Make payment terms explicit to avoid confusion or delays.

State the payment due date prominently, specifying the accepted payment methods and any associated fees or discounts.

If you offer multiple payment options, provide clear instructions on how to proceed with each method.

By ensuring clarity and transparency in your payment terms, you facilitate smoother processing and minimise potential disputes.

Schedule Regular Statement Issuance:

Regularly send statements to your business clients to provide an overview of their account activity.

Statements consolidate multiple invoices and transactions, giving recipients a comprehensive view of their outstanding balances, recent payments, and any credits or adjustments.

Regular statement issuance helps businesses stay informed about their financial obligations and encourages timely payments.

Keep Accurate Records:

Maintain a well-organised record-keeping system for all invoices and statements sent. Digitally archive copies of each communication for easy retrieval and reference.

Accurate records assist in financial analysis, tax reporting, and dispute resolution, should any issues arise in the future.

Leverage Automation and Accounting Software:

Consider utilising accounting software or invoicing platforms to streamline your invoicing and statement processes.

These tools offer features such as automatic invoicing, payment reminders, and integrated tracking, reducing manual effort and enhancing efficiency.

Automation helps eliminate human error, ensures consistency, and frees up valuable time for other business activities.

2.2 Payment Reminders:

Being proactive sending payment reminders and chasers for payment is so important for a robust credit control process.

Otherwise, you are simply relying on your customers making payment on time which doesn’t always happen without a gentle nudge.

Send polite payment reminders just before the invoice is due to be paid to keep your invoice at the front of your client’s mind.

In the event your payment becomes overdue you should have a series of payment chasers ready to send depending on how overdue the invoice is.

Download these free late payment Chase-it templates for letters and emails!

Don’t have time to send reminders and chasers? Don’t sweat-it!

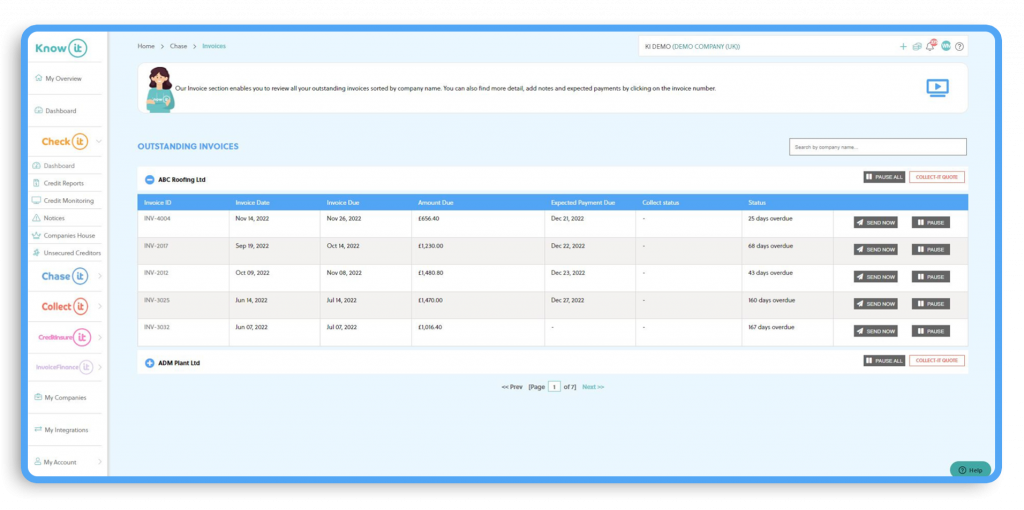

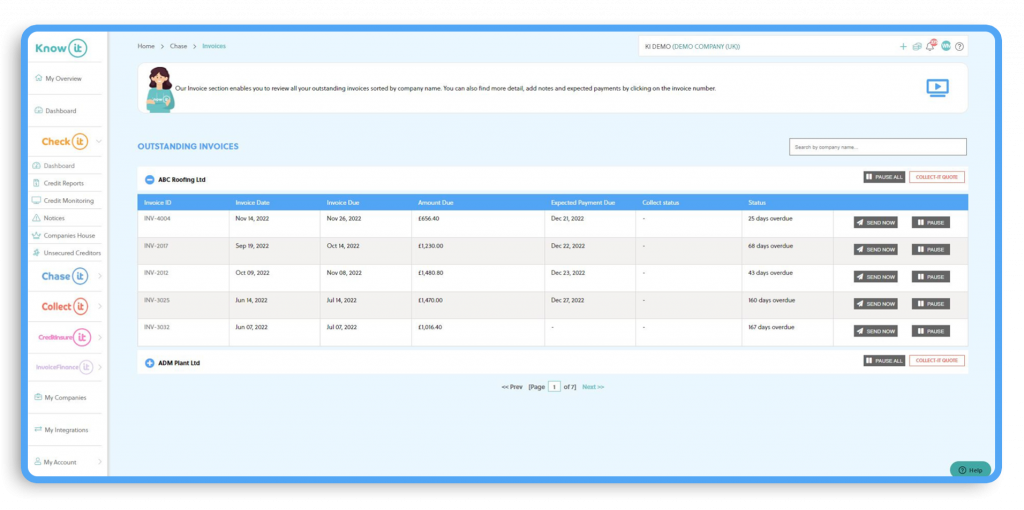

Chase-it automatically sends payment reminders and chasers via email, SMS and letters according to your own schedule using personalised templates.

2.3 Credit Control Measures:

Continually monitoring accounts receivables regularly to identify overdue payments will help you identify potential leaks in your cashflow!

Chase-it allows you to identify your aged debtors so you can initiate timely follow-ups with customers who have outstanding balances.

For problematic cases we recommend implementing credit control measures such as withholding further credit, reducing credit limits, or escalating to a commercial debt recovery agency when necessary.

3: Debt Recovery and Minimising Bad Debt

3.1 Debt Collection Techniques:

Recovering overdue invoices can be a long, laborious process. But it is a necessary process if you’re to collect your overdue amounts.

It’s critical you establish a systematic debt collection process to recover outstanding debts.

This could require assigning dedicated staff or getting an outsourced debt collection specialist to handle the recovery of your accounts.

It’s so important that you keep accurate records of all communication and collection activities.

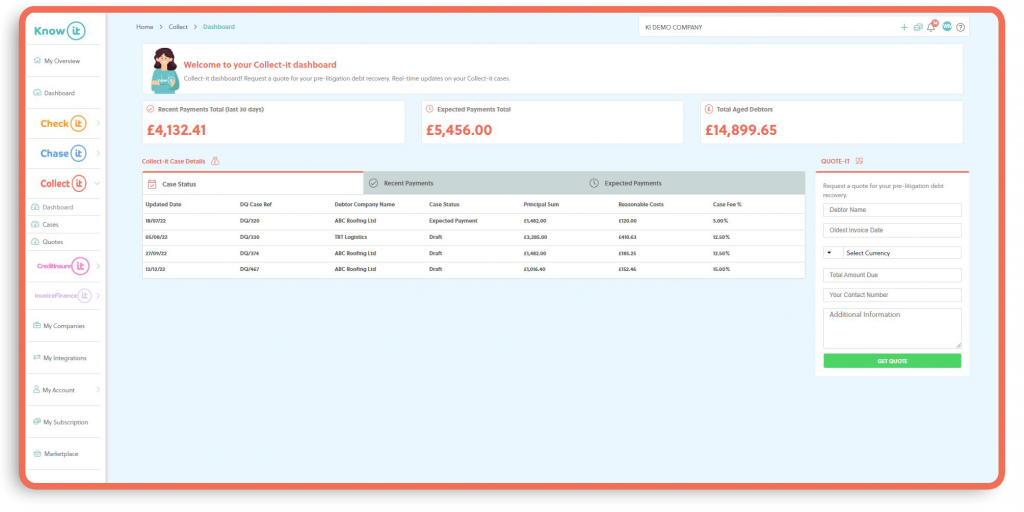

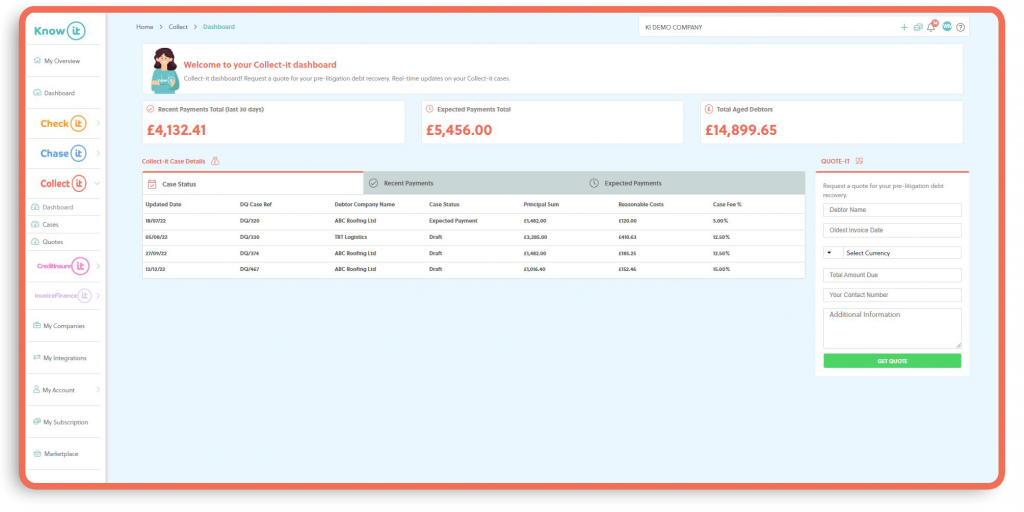

Collect-it allows you to easily send your unpaid invoices to leading commercial debt recovery specialists Darcey Quigley & Co.

When you action a case through Collect-it you’ll receive updates regarding your case with live notifications, so you’re always kept in the know!

Why we’ve partnered with Darcey Quigley & Co

- 93% success rate recovering unpaid invoices.

- 16 years’ experience recovering debts from all over the world.

- No win, no fee debt recovery.

- Fees from just 3%.

- UK & International debt recovery.

- Recover late payment interest & compensation on your behalf as well as your outstanding amount.

- Rated 5 Stars on Trustpilot.

3.2 Negotiation and Payment Plans:

Sometimes you may need to make allowances and accept payment plans to recover the complete overdue amount you’re owed.

Engage in constructive negotiations with customers to settle overdue accounts and consider offering payment plans or structured repayment options to customers facing financial difficulties.

With this in mind, remember to document payment agreements and closely monitor compliance so instalments aren’t missed.

4. Regular Credit Reviews:

Credit reports can change frequently. With this in mind it’s worth conducting periodic credit reviews to reassess customers’ creditworthiness.

Adjust credit limits and terms based on customer payment history and financial stability.

This will allow you to identify high-risk accounts and take proactive measures to mitigate potential losses.

When you purchase a Check-it business credit report we automatically monitor your credit report for any changes so you’re instantly notified of changes to credit scores, ratings and limits!

Remember and get your free business credit report with 12 months automatic monitoring when you sign up to Know-it!

4.1 Cash Flow Forecasting:

Cash flow forecasting acts as an early warning system for your business, allowing you to identify potential cash shortfalls well in advance.

By projecting cash inflows and outflows, you’ll be able to anticipate periods of reduced liquidity and take appropriate actions to bridge the gap.

This may involve negotiating extended payment terms with suppliers, securing additional financing, or adjusting operational expenses.

Timely identification of cash shortfalls enables your business to take proactive measures, minimising the risk of defaulting on payments and maintaining healthy relationships with creditors.

You can use historical data, sales forecasts, and credit payment patterns to project cash inflows.

You should always plan for contingencies and make informed decisions regarding credit management.

Conclusion:

Implementing effective credit control processes is crucial for businesses to mitigate credit risk, reduce debtor days and boost cashflow.

By establishing clear credit policies, monitoring receivables diligently, and employing proactive debt recovery strategies, your business can enhance financial stability and maintain healthy customer relationships.

Automate The Complete Credit Control Process

Know-it streamlines the complete credit control process, allowing you to credit check and monitor companies, automatically send payment reminders and chasers, collect overdue invoices and more all in one place.

We integrate with Xero, Sage, QuickBooks and FreeAgent, making it possible for you to see the credit ratings of all your customers at a glance, easily schedule reminders and chasers for payment and action a debt recovery case in seconds!

Check out a quick demo of the platform!

Signing up is easy and takes seconds! Plus, you’ll get a free business credit report.