Dealing With Trade Debtors To Get Paid Quicker

One of the challenges businesses face is managing trade debtors, as unpaid invoices can significantly impact cashflow and hinder growth.

However, it is essential to handle this delicate situation carefully to maintain positive relationships with your clients.

The most effective way to maximise cashflow is by enhancing your credit control process!

In this article, we will explore effective strategies for dealing with trade debtors and getting paid quicker while preserving your business relationships.

Establish Clear Payment Terms

Setting clear payment terms from the outset is crucial for avoiding misunderstandings and delays.

Clearly communicate your payment expectations, including due dates, accepted payment methods, and any penalties for late payments.

By ensuring that both parties are aware of the agreed terms, you minimise the chances of payment delays and potential disputes.

Invoice Promptly and Accurately

Sending out invoices promptly and accurately is vital for prompt payment.

Ensure that your invoices include all necessary details, such as a clear description of the goods or services provided, payment due dates, and payment instructions.

Make sure that the invoice is addressed to the correct contact person in your client’s organisation to prevent any delays caused by miscommunication.

Offer Incentives for Early Payment

To encourage prompt payment, consider offering incentives such as early payment discounts.

This can motivate trade debtors to settle their invoices quickly, benefiting both parties.

By providing an attractive incentive, you create a win-win situation, as your client saves money, and you receive faster payment.

Implement a Reminder System

Implementing a reminder system helps you stay on top of outstanding invoices.

Send friendly reminders a few days before the payment due date to prompt your clients to make the necessary arrangements.

This will help significantly reduce your debtor days!

Chase-it automatically sends payment reminders and chasers with emails, SMS and letters, ensuring timely reminders without adding unnecessary workload to your staff and saving you time.

Communicate Openly and Professionally

When following up on unpaid invoices, it is essential to maintain a professional and respectful tone in all communication.

Avoid using aggressive or confrontational language that may damage the relationship with your trade debtors.

Instead, adopt a polite and understanding approach while firmly emphasising the importance of timely payment for the smooth continuation of your business relationship.

Offer Flexible Payment Options

Consider offering flexible payment options to facilitate quicker payment.

This can include various payment methods, such as credit cards, online payments, or direct bank transfers.

By providing convenience and flexibility, you increase the likelihood of your trade debtors settling their invoices promptly.

Collaborate on Payment Plans

In cases where your trade debtors are genuinely facing financial difficulties, it may be beneficial to collaborate on a mutually acceptable payment plan.

Openly discuss their situation and explore the possibility of spreading the outstanding amount over a defined period.

By demonstrating empathy and a willingness to find a solution, you can maintain a positive relationship while gradually recovering the debt owed.

Escalate the Matter when Necessary

If all your efforts to secure payment fail, you may need to escalate the matter by involving a commercial debt recovery specialist.

Sometimes the only way to recover outstanding payments is by taking things further and getting the professionals involved.

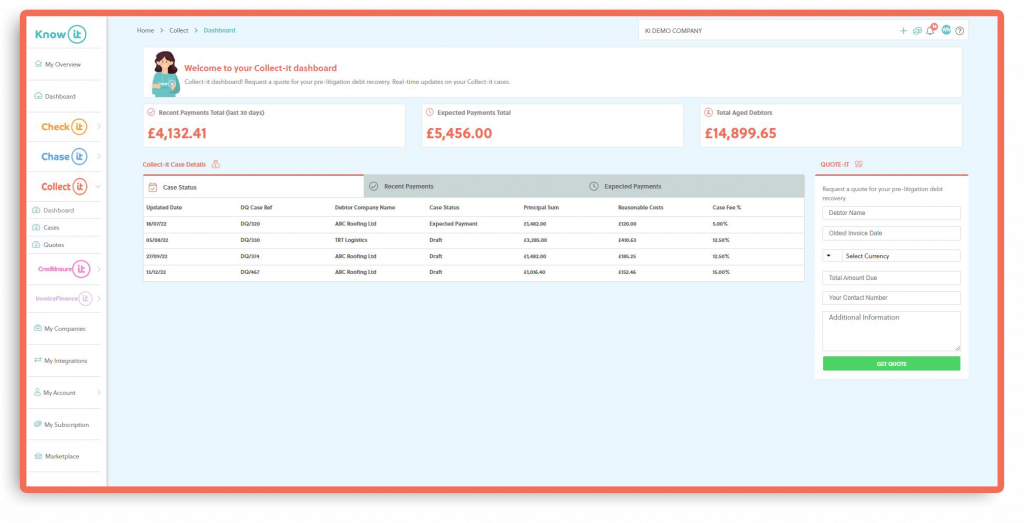

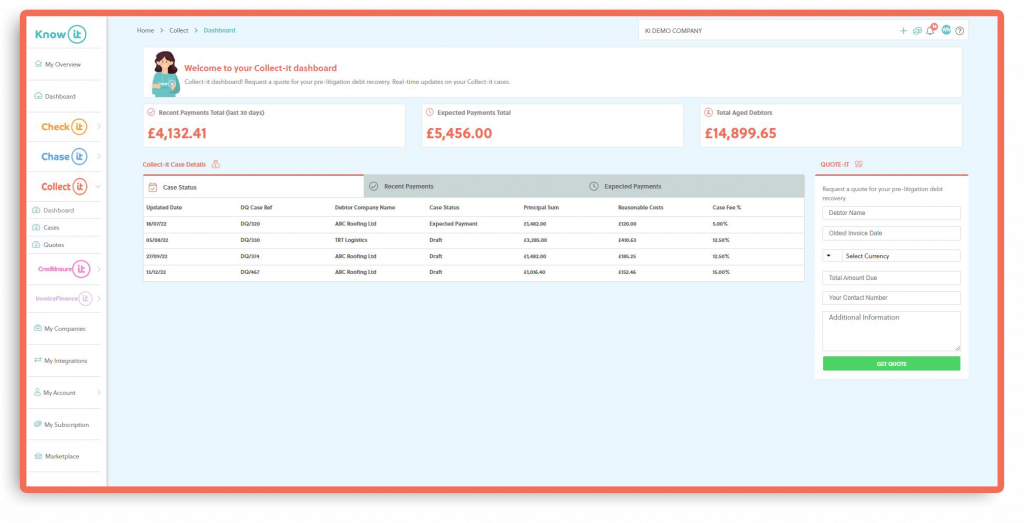

Collect-it gives you the ability to easily action debt recovery cases, get instant quotes and get real-time notifications on updates to your case.

We’ve partnered with UK leading commercial debt recovery specialists Darcey Quigley & Co who handle all debt recovery cases actioned through Collect-it.

Why we’ve partnered with Darcey Quigley & Co

- 93% success rate recovering unpaid invoices.

- 16 years’ experience recovering debts from all over the world.

- No win, no fee debt recovery.

- Fees from just 3%.

- UK & International debt recovery.

- Recover late payment interest & compensation on your behalf as well as your outstanding amount.

- Rated 5 Stars on Trustpilot.

Conclusion

Effectively managing trade debtors is vital for maintaining a healthy cashflow and ensuring the financial stability of your business.

By implementing clear payment terms, invoicing promptly, offering incentives, and communicating professionally, you can encourage your trade debtors to settle their invoices promptly while preserving positive relationships.

Remember, a balanced approach that combines assertiveness with understanding will yield the best results, enabling you to get paid quicker without damaging your business relationships.

Make dealing with trade debtors easier than ever with Know-it

Know-it automates the complete credit control process, streamlining your credit management to make dealing with trade debtors simple and efficient.

Credit check and monitor businesses, automatically send payment reminders and chasers, collect overdue invoices and more, all in one place!

Get started for free today, and get a free business credit report!

Lynne is the Founder and CEO of Know-it!

She is a passionate, driven and forward-thinking entrepreneur determined to help resolve the late payment crisis gripping SMEs.

Having worked within the credit management industry for over 27 years and ran UK leading commercial debt recovery specialists Darcey Quigley & Co for over 16 years, Know-it was devleoped to make credit control more accessilble for SMEs to help them effectively mitigate credit risk, reduce debtor days and boost cashflow!

Connect with me on LinkedIn!