Lack of Loans and Funding Squeezing Cashflow of SMEs

As if SMEs haven’t had enough to juggle over the past couple of years a new report by the Federation of Small Businesses has revealed the cashflow of firms is being constricted by a lack funding and loans.

The latest quarterly Small Business Index (SBI) shows that successful finance applications are at an all-time low!

In fact, Q1 2022 had the lowest proportion of small firms applying for finance in the history of the SBI with just 9% of small firms applying. Of those that did seek finance, just 43% were accepted, again the lowest figures ever recorded.

The fact that things are very bleak for businesses right now yet there are record lows in the number of small firms seeking finance indicates a lack of confidence. The number of firms that took part in the SBI with a “good” credit rating plummeted to just 19%, the lowest point in 6 years.

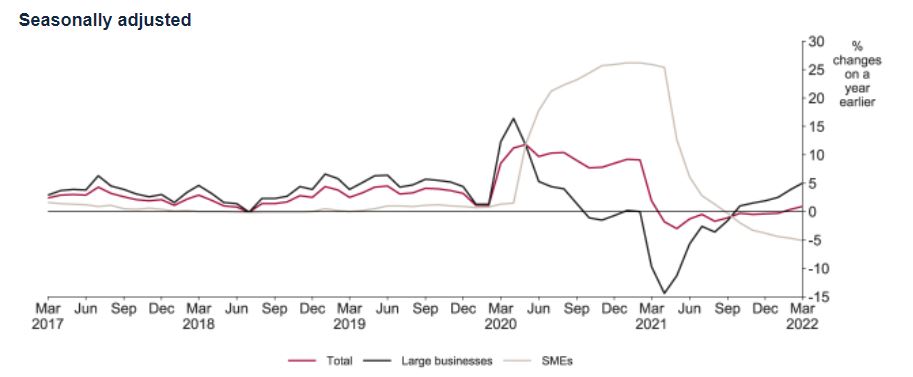

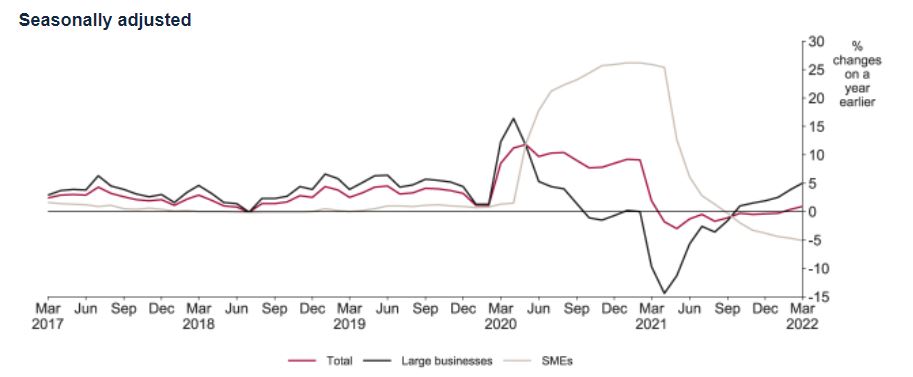

Even more frustratingly is the latest Bank of England figures that show the annual growth rate of lending to SMEs is at a record low, although small businesses made net debt repayments of £0.7 billion in March this year. Lending to big corporates, by contrast, has increased significantly since the start of the year.

Late payments are decimating small businesses

We’re currently in the midst of a late payment crisis. The value of outstanding invoices has rocketed 22% to £61 billion in just a year!

A whopping six in ten businesses are impacted by invoices being paid late.

A change in supply chain practice is urgently needed as we’ve seen Lloyds Bank Commercial Banking say that more than two-thirds of contractors have experienced slower payments. Debtors are most commonly citing late payments from their own customers and cashflow constraints as their reasons for not paying on time.

The FSB have found a staggering number of small firms were affected by late payments with 61% reporting invoices not being paid on time in Q1 2022. What’s more alarming is 26% of these firms are saying late payments are occurring more frequently.

440,000 small businesses could be forced out of business by the late payment crisis and the SBI has revealed 11% of small firms are planning to either close, sell or downsize their businesses. This is more than half a million businesses, heavily impacting the economy.

SMEs are the beating heart of the economy, so these numbers are frightening.

More firms are using finance to relieve cashflow issues

Traditionally we expect businesses to use finance to accelerate growth plans.

However we’re now seeing firms resort to using finance to relieve cashflow pressures. 42% of businesses who took part in the SBI said they planned to use credit to manage cashflow, with just 21% saying they would funds for new equipment, 19% for expansion and only 4% to recruit new members of staff.

Instead of using finance to strive and grow, businesses are using credit just to survive. This will have grave consequences, particularly with rising interest rates.

What other options are available to SMEs?

There are other alternatives to borrowing for businesses struggling with cashflow, particularly those with outstanding invoices.

Optimum Finance offer invoice finance. This means you can access cash trapped in your unpaid invoices before your customer pays! This is a fantastic way to relieve some of the pressure poor cashflow can have, particularly with more invoices being paid late.

Clear Factor provide a single invoice funding solution where trade investors compete to purchase your invoices, granting you capital and relieving the stress that comes with invoices not being paid.

All of these options are viable and it just comes down to preference or what your situation allows for.

However, implementing a sound credit control process should be applied to all businesses.

An all-in-one credit management solution

The late payment crisis is only getting worse and is crippling businesses who don’t have the cashflow to cope.

If businesses are paid quicker, they will be less reliant on using credit and finance to survive, if they’re lucky enough to even have access to it!

50,000 SMEs fail every single year due to not being paid on time. If more businesses can unlock the cash trapped in their overdue invoices, then more firms will be able to keep their doors open and thrive.

Effective credit control protects the cashflow of businesses, but the problem is many SMEs do not have a process in place.

Know-it makes credit control accessible for businesses of all sizes, levelling the playing field.

SMEs now have a full end-to-end credit control process at their finger tips, and it’s fully automated!

- Check-it: Facility to credit report and monitor, alerts to any changes to your customers behaviour through real-time integrations with several public and third-party data sources.

- Chase-it: Automatically chase overdue invoices using customisable email, letters and SMS, seamlessly synchronising with your accountancy package.

- Collect-it: Helps facilitate the collection of unpaid and overdue invoices through our partner Darcey Quigley & Co, UK leading commercial debt recovery specialists.

Start your free 30-day trial today and mitigate credit risk, reduce debtor days and boost cashflow!

Lynne is the Founder and CEO of Know-it!

She is a passionate, driven and forward-thinking entrepreneur determined to help resolve the late payment crisis gripping SMEs.

Having worked within the credit management industry for over 27 years and ran UK leading commercial debt recovery specialists Darcey Quigley & Co for over 16 years, Know-it was devleoped to make credit control more accessilble for SMEs to help them effectively mitigate credit risk, reduce debtor days and boost cashflow!

Connect with me on LinkedIn!