What Are Unsecured Creditor Claims

Here at Know-it we help you uncover a potential cashflow catastrophe before it happens, thanks to our unsecured creditor claims data.

This information is so valuable and will save you the stress of potentially losing out on being paid for invoices you’ve raised.

So, what are unsecured creditor claims?

Unsecured creditor claims identify which of your customers have suffered financial losses as a result of their own customers going into liquidation or administration.

When a company goes insolvent the chances of recovering any money you’re owed from this particular business are extremely slim.

If you can see one of your customers who has an outstanding invoice has just lost out on a substantial sum you can start to contingency plan in the event they struggle to pay their balance when it’s due.

How unsecured creditor claims data works with Know-it

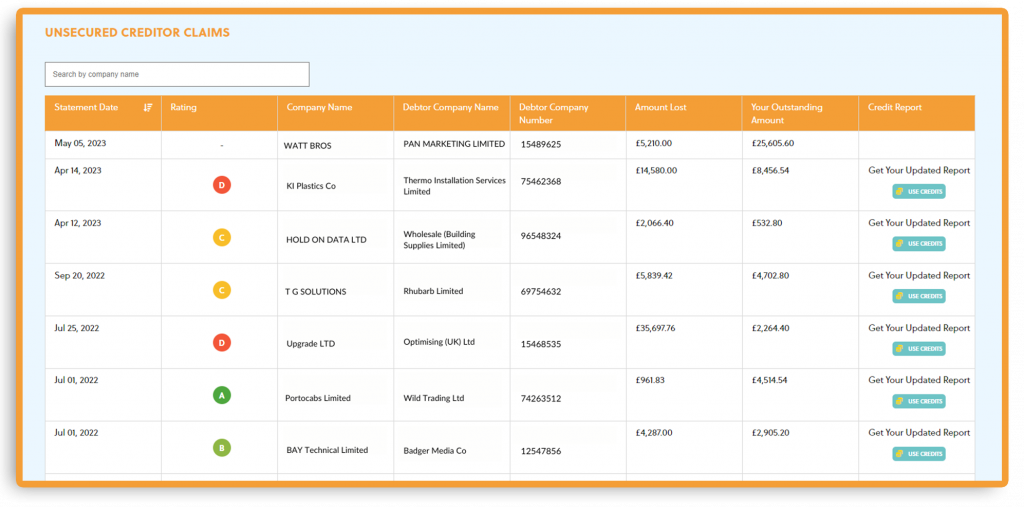

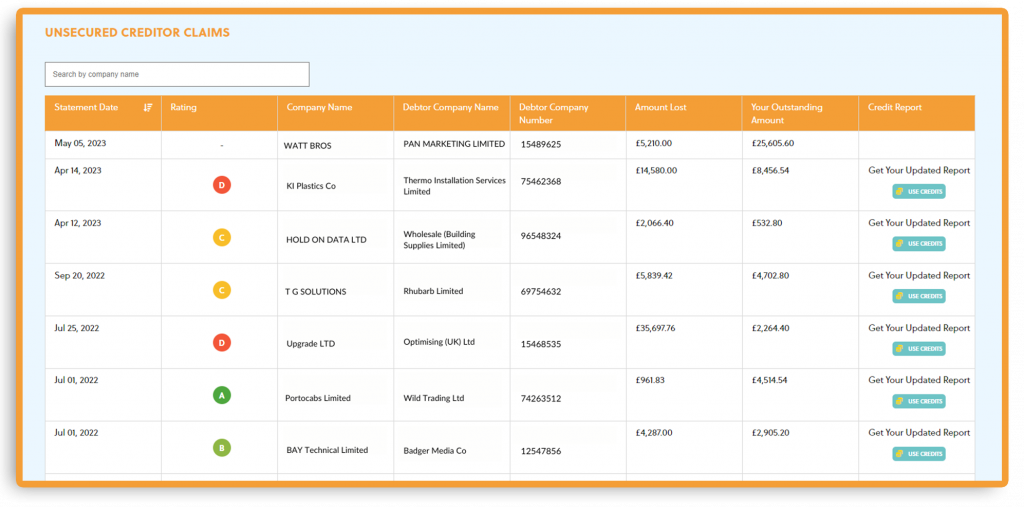

Know-it brings a feed of unsecured creditor claims relating to your customers directly to you!

You’ll see clearly which of your customers have lost money due to administrations or liquidations, the amount lost and the company who owed the outstanding amount.

This will give you a clear indication as to how exposed to risk your business currently is.

Having this level of insight available to you at a glance has the potential to help you avoid extremely heavy losses yourself!

Combine unsecured creditor claims data with your business credit reports for deeper insight

We can’t stress the importance of running business credit reports on your customers. In fact, you should do this every time a business places a new order, whether they’re a new or existing customer.

This is because business credit scores and limits change, they’re not fixed!

Find out more with our complete guide to reading a business credit report!

Just because a business had a great credit rating when they last placed an order doesn’t mean it will still be that way.

Combining a business credit report with unsecured credit claims data will give you a complete view of your customers, their credit worthiness and risk of defaulting on payment as well as financial losses they’ve suffered!

On the Unsecured Creditor Claims screen in the Know-it platform you’ll be able to see their credit rating automatically purchase a credit report for companies listed here instantly.

Check-it brings credit and company data from Creditsafe, The Gazette, Companies House & Unsecured Creditor Claims all into one simple to use platform. Sign-up for free and get a free business credit report!

Connect-it to get full visibility of your customers

The power of Know-it comes from our integration with leading accountancy packages; Xero, Sage, QuickBooks & FreeAgent.

Connect-it and instantly see the credit rating of your customers, any unsecured creditor claims impacting your customers which could, in turn, impact your business, see all of your aged debtors, set up a schedule to automatically chase overdue invoices, easily action a debt recovery case and much more!

Know-it is free to sign-up, plus our free 30-day trial will give you everything you need for a complete and automated credit control process!

What are you waiting for?

Be a Know-it-all today!

Need help getting set up? Schedule a call with us today and we’ll walk you through-it!

Wendy McMurray is Head of Product here at Know-it!

Wendy is passionate about building the best credit management platform possible that will enable more businesses to mitigate credit risk, reduce debtor days & boost cashflow.

An accomplished product manager & innovator with 20 years experience and a proven track record in designing, developing and delivering ground-breaking SaaS products!

Connect with me on LinkedIn!