Leveraging Credit Control

Maintaining a healthy cashflow through credit control is crucial for the long-term success and sustainability of any enterprise, especially against the backdrop of soaring insolvencies and record instances of late payment.

One effective strategy for achieving this goal is to implement a robust credit control system.

By effectively managing your business’s credit and collection processes, you can optimise cashflow, minimise bad debt, and enhance overall financial health.

In this article, we will explore the concept of credit control and discuss how it can be leveraged to improve your business’s financial well-being.

Understanding Credit Control

Credit control refers to the practices and procedures implemented by a business to ensure that credit is extended to customers in a controlled and responsible manner.

It involves assessing the creditworthiness of customers, setting credit limits, monitoring outstanding balances, and efficiently collecting payments.

A well-designed credit control system helps a business strike a balance between providing credit to facilitate sales and mitigating the credit risk of non-payment or bad debt.

Benefits of Effective Credit Control

Improved Cashflow

Efficient credit control enables timely payment collection, reducing the risk of late or non-payment.

This improves cashflow and provides your business with the necessary funds to meet financial obligations and invest in growth opportunities.

Reduced Bad Debt

By carefully evaluating the creditworthiness of customers and setting appropriate credit limits, you can minimise the risk of bad debt.

Effective credit control procedures, such as regular monitoring of outstanding balances and proactive debt recovery, ensure that any potential issues are addressed promptly, reducing the likelihood of significant losses.

Stronger Customer Relationships

Implementing credit control processes helps establish clear terms and conditions for credit sales.

This fosters transparency and trust between your business and customers, enhancing overall customer satisfaction and loyalty.

Increased Profitability

By minimising bad debt and improving cashflow, effective credit control directly contributes to your business’s profitability.

With more resources available for investment and growth, you can take advantage of new opportunities and achieve long-term financial success.

Key Strategies for Leveraging Credit Control

Accurate Business Credit Reporting

Implement a thorough business credit reporting process to evaluate the creditworthiness of potential customers.

An accurate business credit report will allow you to set appropriate credit limits based on the customer’s financial position and payment history.

A good business credit report will give you:

- Credit rating.

- Credit score.

- Credit limit.

- Track record of recent payments.

- Any defaults on payment or CCJs you should be aware of.

Check-it business credit reports go a step further though. We bring credit data from Creditsafe as well as company data from The Gazette and Companies House to give you a complete overview of a company.

We also provide you with Unsecured Creditor Claims data which allows you to see losses suffered by your customers as a result of their own customers going into administration or liquidation!

Plus, we automatically monitor business credit reports for any changes and instantly alert you, helping you keep on top of potential credit risks.

Clear Terms and Conditions

Clearly define credit terms, including payment due dates, interest rates for late payments, and consequences for non-payment.

Provide this information to customers in writing and obtain their agreement to the terms. This helps manage expectations and ensures both parties are aware of their obligations.

Regular Monitoring of Your Aged Debtors

Continuously monitor outstanding balances, aging of receivables and aged debtors.

Implement an efficient system to track payments and identify potential late or non-paying customers.

Timely intervention can help prevent minor issues from escalating into significant bad debt.

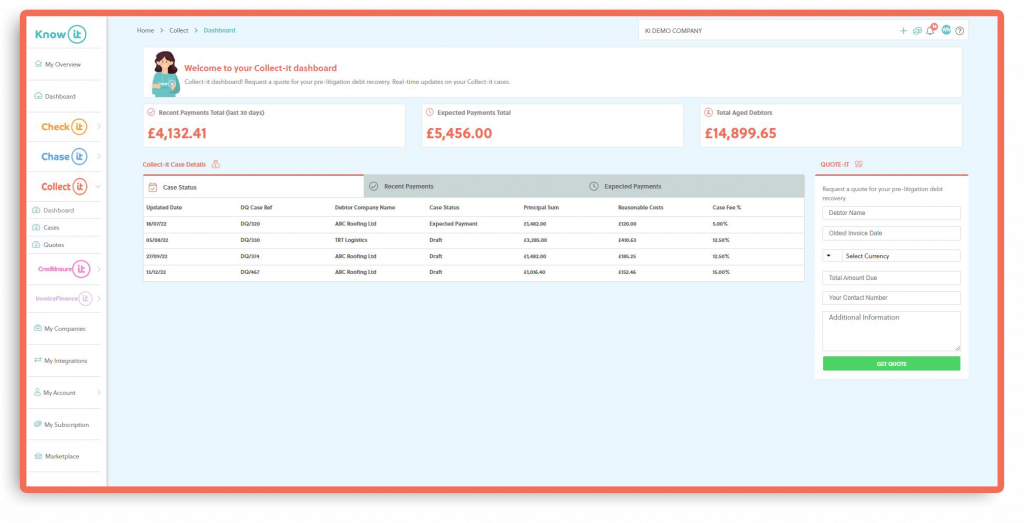

By connecting your sales ledger with Know-it you’ll see a complete overview of your outstanding balances, aging of receivables and aged debtors allowing you to take action on the most urgent invoices and debtors first!

Prompt Invoicing and Payment Reminders

Issue accurate and timely invoices to customers.

Use automated systems to generate invoices and send payment reminders and chasers to encourage payment to be made quickly.

Effective Debt Recovery

Establish a clear process for debt recovery, including escalation procedures for overdue payments.

Promptly follow up with customers who miss payment deadlines and offer assistance or alternative payment arrangements when necessary.

Consider using a debt collection agency if internal efforts are unsuccessful.

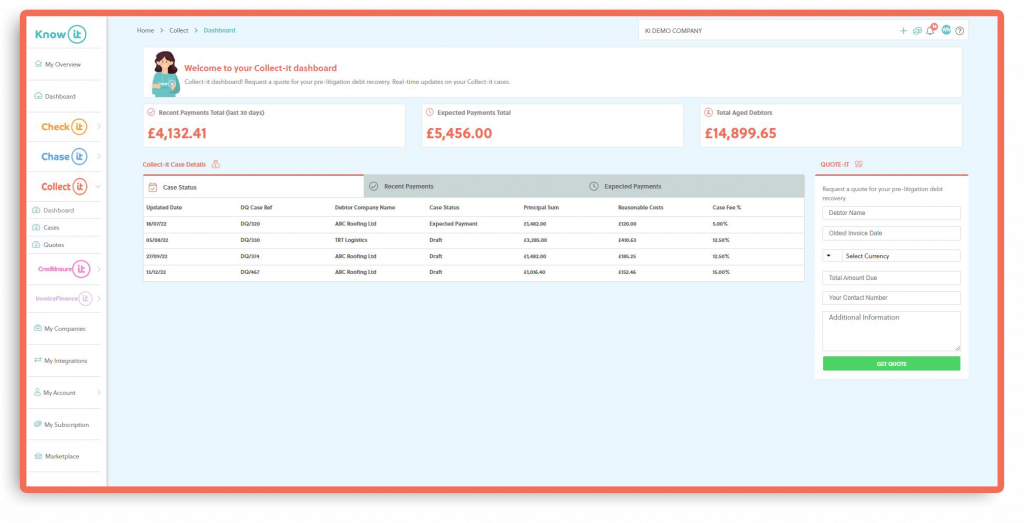

Collect-it brings UK leading commercial debt recovery specialists Darcey Quigley & Co directly to you!

Seamlessly send your overdue invoices for recovery and get free instant quotes, with fees starting from just 3%!

Once your case has been actioned you’ll be instantly notified of any updates to your Collect-it case so you’re always kept in the know!

Regular Review and Improvement of Credit Control Processes

By continuously reviewing and refining your credit control procedures to adapt to changing market conditions and customer behaviours you will drastically reduce debtor days and see a significant improvement to your cashflow.

Analyse key metrics such as average collection period, bad debt ratio, and customer payment trends. Identify areas for improvement and implement appropriate changes.

Know-it makes credit control simple by streamlining the complete process through automation.

Start now for free and get a free company credit report!

Lynne is the Founder and CEO of Know-it!

She is a passionate, driven and forward-thinking entrepreneur determined to help resolve the late payment crisis gripping SMEs.

Having worked within the credit management industry for over 27 years and ran UK leading commercial debt recovery specialists Darcey Quigley & Co for over 16 years, Know-it was devleoped to make credit control more accessilble for SMEs to help them effectively mitigate credit risk, reduce debtor days and boost cashflow!

Connect with me on LinkedIn!