The Role of Technology in Credit Control

In today’s fast-paced and interconnected world, credit control has become a vital aspect of financial management for businesses.

Traditionally, credit management involved manual processes and relied heavily on human intervention, which often proved time-consuming and prone to errors.

However, with the advent of advanced technologies, the landscape of credit control has undergone a remarkable transformation.

This article explores the pivotal role that technology plays in credit management, revolutionising the way businesses manage credit, minimise risks, and improve financial performance.

Automation and Efficiency in Credit Control

Technology has brought unprecedented levels of automation and efficiency to credit control processes.

With the help of sophisticated software solutions, businesses can streamline and automate various credit management tasks, such as business credit checking and reporting, credit scoring, and credit monitoring.

By leveraging automation, companies can significantly reduce the time and effort required for manual data entry, analysis, and decision-making.

This leads to faster processing times, improved accuracy, and enhanced productivity, allowing credit control teams to focus on more strategic activities.

Know-it automates the complete credit management process end-to-end. Now you can credit check and monitor companies, automatically send payment chasers and reminders, collect overdue invoices and more in one place!

Check out this short demo to see how-it works!

Enhanced Data Analysis

One of the significant advantages of technology in credit control is its ability to process vast amounts of data quickly and accurately.

Advanced data analytics tools can analyse credit-related information from multiple sources, including credit reports, financial statements, and customer payment histories.

By examining patterns and trends in this data, technology enables businesses to make more informed credit decisions.

These insights help identify potential risks, predict payment behaviours, and customise credit terms based on individual customer profiles.

Consequently, businesses can optimise credit management strategies to minimise bad debt, improve cash flow, and maximise profitability.

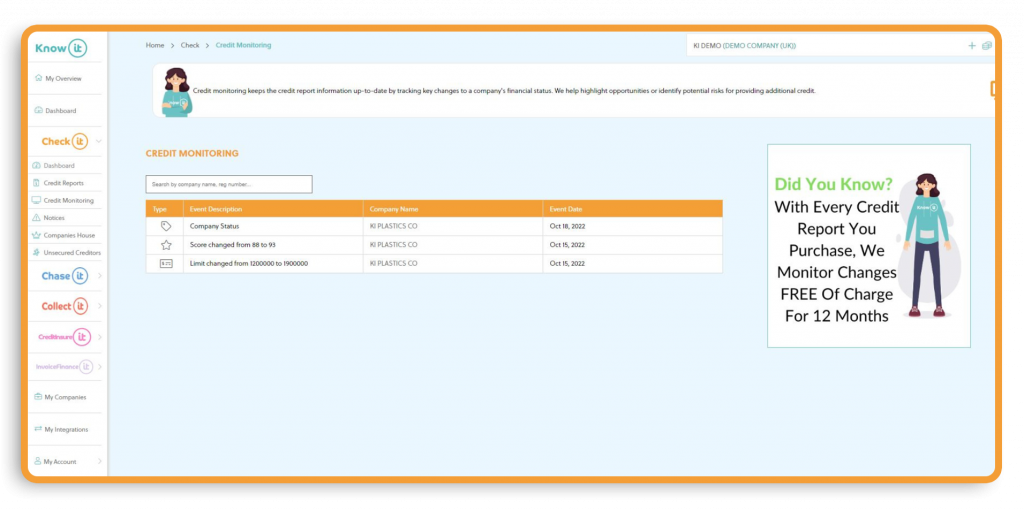

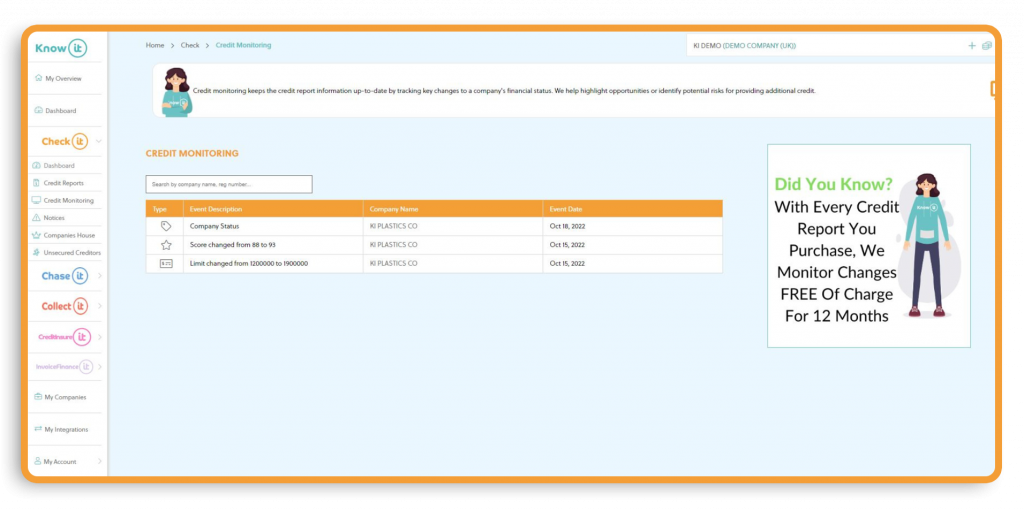

Real-Time Monitoring and Alerts For Credit Control

Technology empowers businesses to monitor credit activities in real time, providing valuable insights into customer behaviour and financial health.

Through integrated systems and platforms, organisations can track customer payment patterns, credit limits, and outstanding balances.

This real-time monitoring enables prompt identification of potential credit issues, such as late payments or exceeding credit limits.

By setting up automated alerts, businesses can proactively manage credit risks, take necessary actions, and avoid potential losses.

This level of visibility and control ensures that credit management measures are proactive, responsive, and well-informed.

Check-it instantly notifies you of any changes to a business credit report, score, rating or limit so you’re always kept in the know!

Seamless Communication and Collaboration

Effective credit management often requires close collaboration and communication between credit control teams, sales teams, and customers.

Technology facilitates seamless communication through various channels, such as email, messaging platforms, and customer portals.

Instant communication allows finance teams to address customer queries, resolve disputes, and negotiate payment terms efficiently.

Additionally, technology-enabled collaboration platforms enable different departments within an organisation to access relevant credit-related information, improving cross-functional coordination and decision-making.

When it comes to communicating with your customers regarding late payments, it can sometimes be a difficult conversation to have. By automating this through Chase-it you avoid these uncomfortable conversations whilst also ensuring you don’t miss any invoices!

Chase-it allows you to schedule payment reminders and chasers to automatically send via email, SMS and letter using fully customisable templates.

Accessibility

Technology has helped make credit control accessible for businesses of all sizes.

Up until now, only huge corporations were able to afford to pay for the tools required for a robust credit management process. This involved paying for multiple services and long contracts for their credit control.

Know-it, being a cloud-based platform, brings everything you need for better credit control into one place thanks to our data integrations with Creditsafe, The Gazette, Companies House, Unsecured Creditor Claims and Microsoft 365.

This means you have a completely automated credit control process with one affordable monthly cost, with no contract or tie-ins!

Conclusion

The role of technology in credit control cannot be overstated.

It has transformed the way businesses manage credit by enhancing automation, improving data analysis capabilities, enabling real-time monitoring, facilitating seamless communication, enhancing credit scoring models whilst making credit control accessible for millions more SMEs!

By embracing technology, organisations can optimise their credit management processes, minimise risks, and improve overall financial performance.

As technology continues to advance, the future of credit management promises even more innovative solutions to further streamline credit management and drive sustainable growth.

Start automating your complete credit control process with Know-it! Start for free now and get a free company credit report.

Lynne is the Founder and CEO of Know-it!

She is a passionate, driven and forward-thinking entrepreneur determined to help resolve the late payment crisis gripping SMEs.

Having worked within the credit management industry for over 27 years and ran UK leading commercial debt recovery specialists Darcey Quigley & Co for over 16 years, Know-it was devleoped to make credit control more accessilble for SMEs to help them effectively mitigate credit risk, reduce debtor days and boost cashflow!

Connect with me on LinkedIn!