Maximising Cashflow: Enhancing Your Credit Control Process

Effective credit control is crucial for maintaining a healthy cashflow and financial stability.

By implementing a well-structured credit control process, businesses can mitigate the risks associated with late payments and bad debts, ensuring a steady stream of revenue.

In this article, we will explore strategies to optimise your credit control process, helping you maximise cashflow!

Establish clear credit policies

The foundation of an efficient credit control process lies in having well-defined credit policies.

Clearly communicate your terms and conditions to customers, including credit limits, payment deadlines, and consequences for late or non-payment.

By setting expectations from the outset, you minimise the chances of payment delays or disputes.

Conduct thorough credit checks

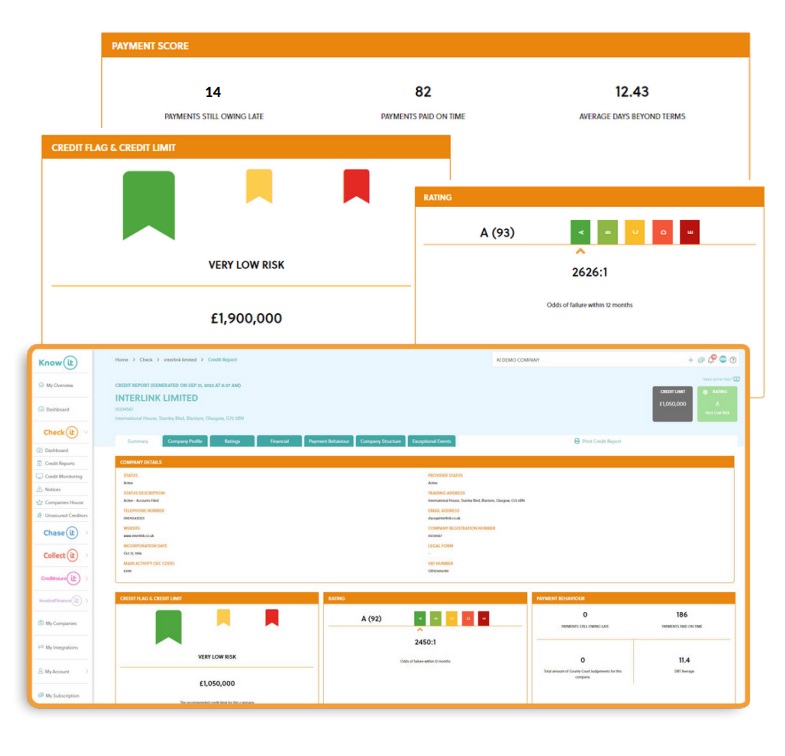

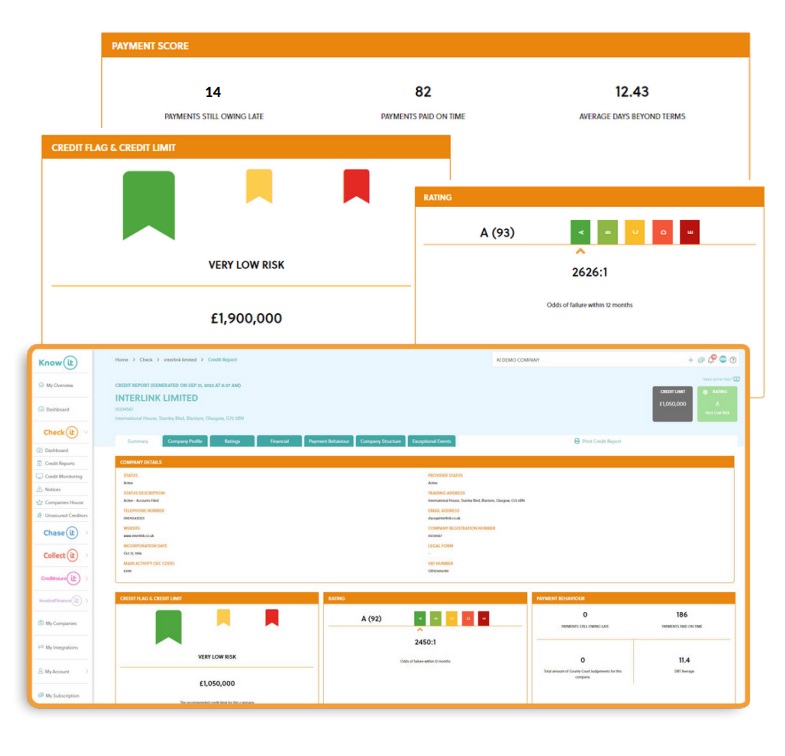

Before extending credit to customers, conduct comprehensive credit checks to assess their creditworthiness.

Utilise credit reference agencies, trade references, and financial statements to evaluate their payment history, financial stability, and ability to meet payment obligations.

This proactive approach helps you identify potential risks and make informed decisions about credit limits and payment terms.

Check-it provides you with business credit reports using Creditsafe data, which can predict almost 70% of all insolvencies up to 12 months in advance!

This intelligence, partnered with Unsecured Creditors Claims data in the Know-it platform, will provide users with unparalleled financial data on the companies they do business with.

Our Unsecured Creditor Claims data identifies which of your customers have suffered losses as a result of their own customers going into liquidation or administration, allowing you to anticipate a potential cashflow disaster before it’s too late!

Plus, with our automatic credit monitoring services you’ll be instantly notified of any changes to reports, ratings and limits.

Implement a robust invoicing system

Efficient invoicing is critical to prompt payment.

Ensure your invoices are accurate, transparent, and easy to understand.

Clearly state payment terms, due dates, and available payment methods.

Utilise invoicing software to automate the process, enabling you to generate and send invoices promptly.

Additionally, consider including early payment incentives to encourage customers to settle their dues swiftly.

Need help writing an invoice email? Take a look at our guide!

Promptly follow up on overdue payments

Establish a structured process for following up on overdue payments.

Send reminders a few days before the due date and follow up promptly if payments are not received.

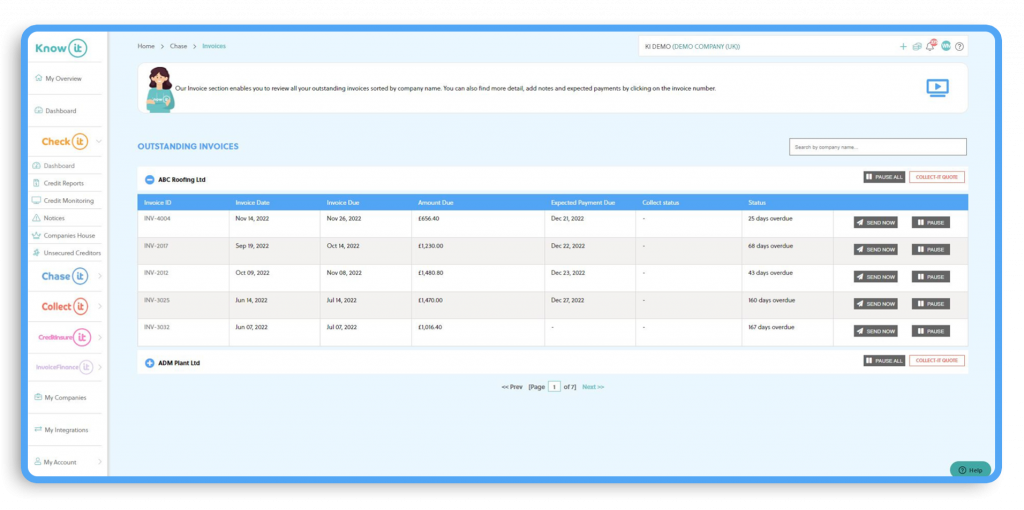

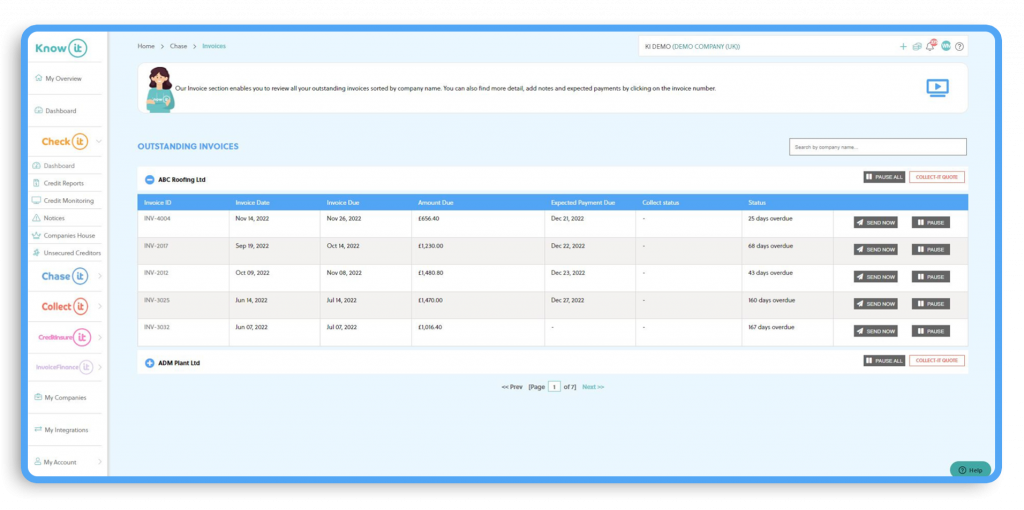

Utilise technology to automate reminders and chasers using Chase-it!

Chase-it gives you the power to schedule payment reminders and chasers to automatically send via email, SMS and letter using fully customisable templates.

Personalising your communications is critical and it’s vital you are persistent, escalating the matter to higher management levels if necessary. This proactive approach encourages prompt payment and demonstrates your commitment to credit control.

By automating the process, you minimise the risk of missing payment and avoid the sometimes difficult conversation of asking clients for payment.

Offer flexible payment options

To facilitate timely payments, offer a range of convenient payment options to your customers.

Accept credit/debit card payments, electronic fund transfers, and online payment gateways.

Providing multiple channels for payment increases the likelihood of customers settling their dues promptly, improving your cashflow!

Regularly monitor and analyse receivables

Maintain a vigilant eye on your receivables by regularly monitoring and analysing the aging of your outstanding invoices.

Utilise accounting software or dedicated debt management tools to generate reports and identify overdue accounts.

Prioritise follow-up actions based on the age and value of outstanding debts, allowing you to focus your resources effectively and expedite collections.

Know-it seamlessly connects with Xero, Sage, QuickBooks and FreeAgent. You’ll be able to see all of your aged debtors, amounts outstanding and due dates at a glance so you can take swift action to encourage payment to be made quickly.

Strengthen customer relationships

While credit control involves managing financial aspects, fostering strong customer relationships is equally important.

Maintain open lines of communication with your customers, addressing any concerns or disputes promptly. By building positive relationships based on trust and transparency, you can encourage timely payments and reduce the likelihood of late or non-payment issues.

Optimising your credit control process is crucial for maximising cashflow and ensuring the financial stability of your business.

By establishing clear credit policies, conducting thorough credit checks, implementing robust invoicing systems, promptly following up on overdue payments, offering flexible payment options, monitoring receivables, and strengthening customer relationships, you can streamline your credit control process and minimise the risks associated with late payments and bad debts.

Remember, a proactive and systematic approach to credit control is key to maintaining a healthy cashflow and achieving sustainable financial success. By continuously improving and fine-tuning your credit control process, you can effectively manage your receivables and optimise your business’s financial performance.

Automate the complete credit control process

Know-it automates the complete credit control process, saving you time by streamlining all of your credit management.

Credit check and monitor for changes, automatically send payment reminders and chasers, recover overdue invoices and more, all in one place!

No credit card required.

Lynne is the Founder and CEO of Know-it!

She is a passionate, driven and forward-thinking entrepreneur determined to help resolve the late payment crisis gripping SMEs.

Having worked within the credit management industry for over 27 years and ran UK leading commercial debt recovery specialists Darcey Quigley & Co for over 16 years, Know-it was devleoped to make credit control more accessilble for SMEs to help them effectively mitigate credit risk, reduce debtor days and boost cashflow!

Connect with me on LinkedIn!